Table of Contents

Introduction: The Common Question About Filing ITR

Every year when tax season arrives, millions of people ask the same question: “Why should I file Income Tax Return if I don’t have any tax to pay?” This doubt is common, especially among young earners, retirees, students, or those whose incomes fall below the taxable threshold. Many assume filing ITR is only for salaried individuals with high incomes.

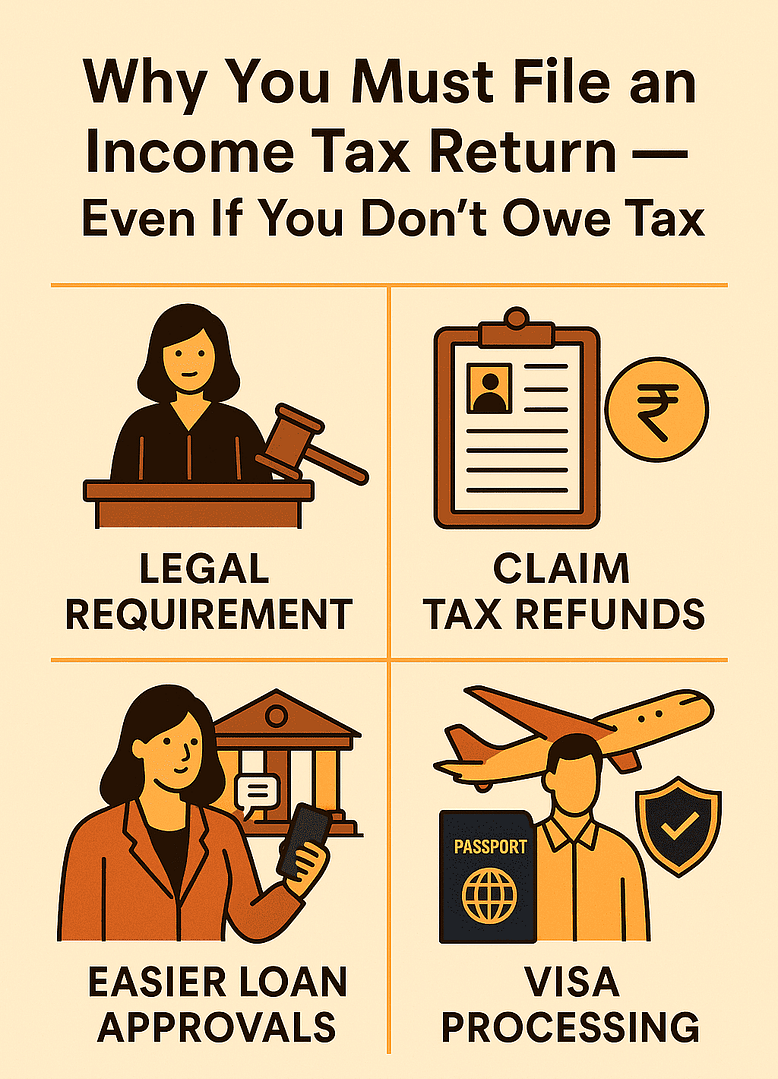

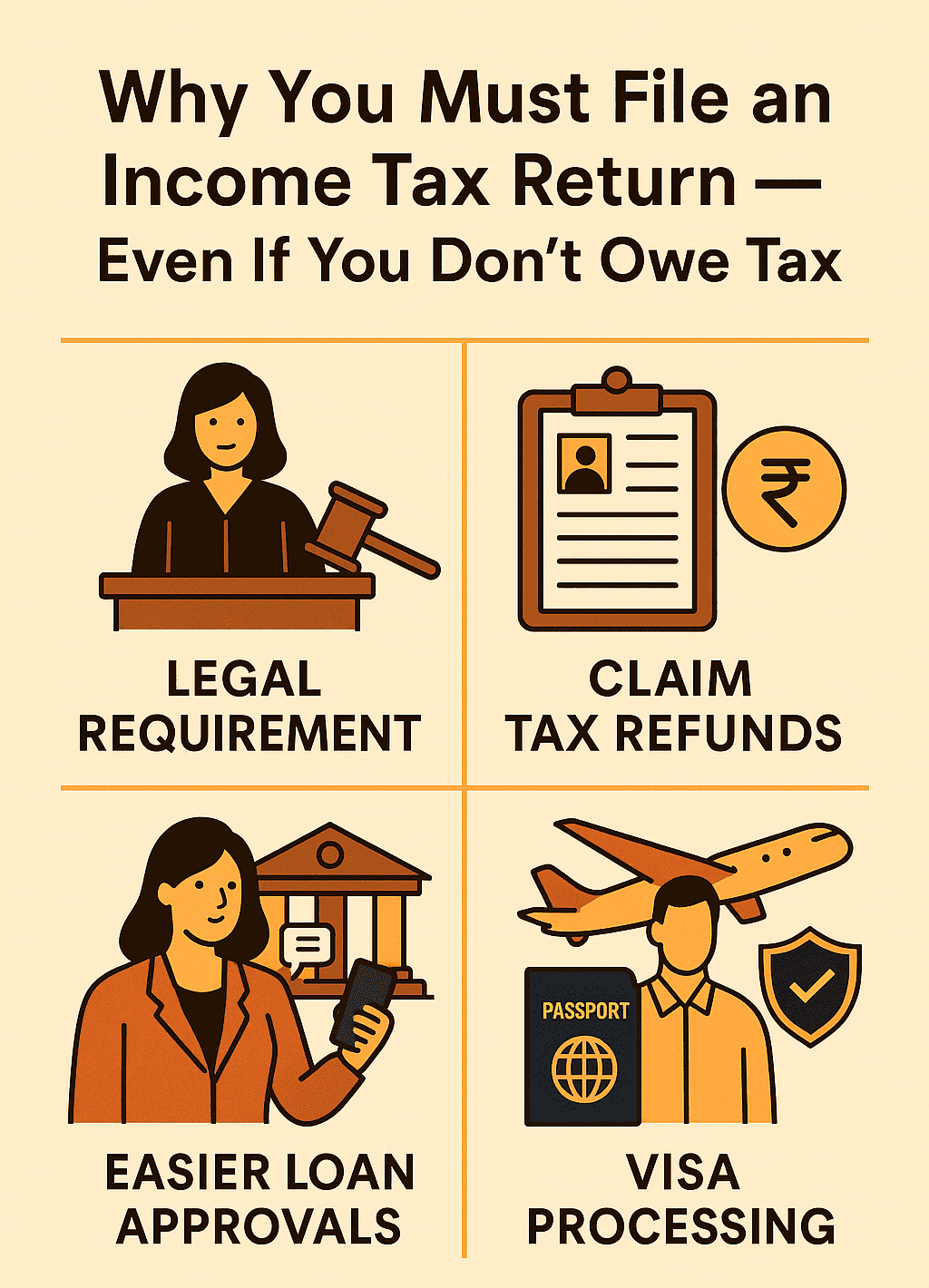

However, this belief is far from the truth. Filing an ITR is not only a legal duty for eligible taxpayers but also a smart financial habit that can bring multiple benefits. From easy loan approvals to proof of income for visas, there are countless reasons why filing your return matters.

What Is an Income Tax Return (ITR)?

Definition and Purpose

An Income Tax Return (ITR) is a formal document that records your income, tax deductions, and tax payments in a financial year. It is submitted to the government’s tax authority to ensure transparency and compliance. Even if your tax liability is zero, filing ITR helps establish your financial history.

Who Needs to File an ITR?

Typically, individuals whose income exceeds the exemption limit must file returns. But beyond that, even people with smaller incomes may benefit from voluntary filing. This is because ITR acts as an official financial statement recognized by banks, government bodies, and foreign institutions.

Why Should I File Income Tax Return?

Legal Obligation Under Income Tax Law

If your income crosses the minimum threshold set by tax authorities, you are legally required to file an ITR. Non-compliance can result in penalties or even prosecution. Filing keeps you on the right side of the law and prevents unnecessary trouble.

Avoiding Penalties and Notices

Failing to file on time can attract penalties, late fees, and notices from the tax department. Even if you owe nothing, filing ensures you remain free from legal complications. It’s always better to stay compliant than to face government scrutiny later.

Carry Forward of Losses

Investors and business owners often face financial losses. Filing ITR allows you to carry forward these losses to future years and adjust them against future gains. Without filing, you lose this valuable opportunity.

Easy Loan & Credit Card Approvals

Banks, NBFCs, and even fintech companies ask for ITR copies while processing loans or issuing credit cards. Your ITR serves as proof of income and repayment capacity, increasing your chances of quick approval.

Visa Applications and International Travel

Planning to study abroad or travel overseas? Embassies often ask for ITR copies during visa applications. Filing shows you are financially stable and responsible, which increases your chances of approval.

Proof of Income for Financial Security

Your ITR is a legitimate proof of income. It can be used while applying for government subsidies, claiming insurance benefits, or settling disputes. Unlike salary slips, it is a government-recognized document that carries more weight.

Filing ITR Even Without Tax Liability

Income Below Taxable Limit

Even if your income doesn’t cross the exemption limit, filing can still be useful. Many people receive refunds for TDS deducted on bank interest or other payments. Without filing, you cannot claim this money back.

Students, Housewives, and Freelancers

Students who do internships, housewives who earn from side businesses, and freelancers often underestimate the power of filing ITR. Even if the income is small, building a financial history today can make credit applications easier in the future.

Senior Citizens and Pensioners

Senior citizens sometimes believe they don’t need to file if their pension income is below limits. But filing ensures they can claim deductions on medical expenses, interest, and other exemptions reserved for them.

Key Benefits of Filing Income Tax Return

Claiming Tax Refunds

Have you ever noticed that banks deduct tax on your fixed deposit interest? That money can only be reclaimed through ITR filing. Thousands of taxpayers each year get refunds because they filed their return, even though they had no tax liability.

Establishing Financial Credibility

Lenders, insurers, and even government bodies use your ITR to evaluate your financial standing. Filing consistently creates a reliable financial track record, proving that you are a responsible citizen.

Avoiding Legal Troubles

Not filing your return when required may invite notices or penalties. Even if you are below the limit, voluntarily filing reduces your risk and strengthens your credibility with authorities.

Common Myths About Filing ITR

“I Don’t Earn Much, So I Don’t Need To”

This is one of the biggest myths. Even if you don’t earn much, you might still be eligible for refunds or exemptions. Filing ensures you don’t miss out on money that belongs to you.

“Filing Is Too Complicated”

With today’s user-friendly online portals and mobile apps, filing has become simpler than ever. Most forms are pre-filled, and even beginners can file within minutes.

“Only Salaried People File Returns”

Another misconception is that only employees of big companies need to file. Freelancers, business owners, and even homemakers with small investments may also benefit from filing.

Step-by-Step Guide: How to File an Income Tax Return Online

Registering on the Income Tax Portal

The first step is registering on the official portal using your PAN, Aadhaar, and bank account details. Registration is quick and mandatory before you can proceed.

Choosing the Correct ITR Form

There are different ITR forms depending on whether you are salaried, self-employed, or a business owner. Selecting the correct form ensures your return isn’t rejected later.

Uploading Income Details

Once logged in, you must enter your income sources, deductions, and tax payments. Be honest and accurate, as the system cross-checks information with banks and employers.

E-Verification and Completion

After submitting, verify your return using Aadhaar OTP, net banking, or a digital signature. Without verification, your ITR will remain incomplete.

Mistakes to Avoid While Filing ITR

Providing Incorrect Bank Details

Many refunds are delayed simply because taxpayers entered the wrong account number or IFSC code. Always double-check before submitting.

Not Reporting All Income Sources

Side income from freelance work, rental property, or savings account interest must also be declared. Hiding income can cause future legal problems.

Missing the Deadline

Late filing attracts penalties, and in some cases, you may even lose the ability to carry forward losses. Always file before the due date to stay safe.

Consequences of Not Filing an Income Tax Return

Penalties and Late Fees

Depending on your jurisdiction, you could be fined between ₹1,000 and ₹5,000 for missing deadlines. This is an unnecessary expense that can be avoided by timely filing.

Legal Action and Prosecution

For serious cases of willful default, authorities can launch legal proceedings. This can damage your reputation and financial future.

Difficulty in Future Financial Planning

Without ITR records, applying for a home loan, starting a business, or even proving your income becomes challenging. It may also create roadblocks in international travel.

Government Initiatives for Simplified ITR Filing

Pre-Filled ITR Forms

The government has simplified filing by providing pre-filled forms with salary, TDS, and interest details. This reduces errors and saves time.

E-Filing Assistance and Help Centers

Dedicated help centers, mobile apps, and official guidance notes are now available. This ensures even first-time taxpayers can file with ease.

Expert Tips for Hassle-Free Filing

Keep All Documents Ready

Before filing, collect PAN, Aadhaar, salary slips, Form 16, investment proofs, and bank statements. Being organized saves time.

Use a Chartered Accountant If Needed

If your income is complex or includes multiple sources, hiring a professional ensures accuracy. This is especially helpful for business owners.

File Early to Avoid Rush

Most taxpayers wait until the last week, leading to server issues. Filing early avoids stress and ensures error-free submission.

FAQs on Filing Income Tax Return

Q1: Why should I file Income Tax Return if I don’t have taxable income?

Even if you don’t owe taxes, filing helps you claim refunds, build a financial history, and access loans easily.

Q2: What happens if I don’t file ITR?

You may face penalties, lose the ability to carry forward losses, and face problems in getting loans or visas.

Q3: Can students or housewives file ITR?

Yes, they can. Filing helps them create a credit history and claim refunds on small earnings or investments.

Q4: Is filing ITR mandatory every year?

Yes, if your income exceeds the threshold. Even if not, voluntary filing offers many benefits.

Q5: Can I file ITR online without a CA?

Absolutely. The government portal is user-friendly, and most details are pre-filled for convenience.

Q6: Does ITR help in getting a visa?

Yes. Embassies often request ITR copies to verify income stability before approving travel or study visas.

Conclusion: Filing ITR as a Step Toward Financial Discipline

Filing an Income Tax Return is more than just a tax obligation—it is a tool for financial discipline and future security. Whether you owe tax or not, filing provides proof of income, builds credibility, and opens opportunities for refunds and financial growth.

So, the next time you wonder “Why should I file Income Tax Return?”, remember: it’s not just about paying taxes—it’s about creating a foundation for your financial future.