Introduction

Starting a business is exciting, but one of the first and most important decisions you’ll face is choosing the right legal structure. The registration process LLP Pvt Ltd is a common point of confusion for many entrepreneurs in India. Both a Limited Liability Partnership (LLP) and a Private Limited Company (Pvt Ltd) provide a separate legal status, protect owners’ liability, and are recognized by law. However, they differ in terms of compliance, taxation, investment opportunities, and credibility.

In this detailed guide, we’ll walk you through everything you need to know—from legal status to registration steps, advantages and disadvantages, cost comparison, and frequently asked questions. By the end, you’ll be able to decide which structure—LLP or Pvt Ltd—is best suited for your business idea.

Table of Contents

Understanding LLP and Private Limited Company

What is an LLP?

A Limited Liability Partnership (LLP) is a hybrid structure that blends the flexibility of a partnership with the limited liability of a company. It was introduced in India under the LLP Act, 2008. Partners are not personally responsible for the firm’s debts, and compliance is simpler compared to a Pvt Ltd company. LLPs are popular among small businesses, professional services, and family-run enterprises.

What is a Private Limited Company?

A Private Limited Company (Pvt Ltd) is one of the most preferred business structures in India, governed by the Companies Act, 2013. It offers limited liability to shareholders, has perpetual succession, and allows easy fundraising. Pvt Ltd companies are commonly chosen by startups, SMEs, and businesses aiming for long-term scalability.

Legal Status of LLP vs Private Limited

Both LLPs and Pvt Ltd companies are recognized as separate legal entities under Indian law. This means they can own assets, enter into contracts, sue, and be sued in their own names.

- Separate Legal Entity: Both structures keep business finances and liabilities separate from personal assets. This ensures the business has its own identity independent of its owners.

- Perpetual Succession: Even if partners or directors leave or pass away, the business continues without disruption.

- Liability Protection: Owners’ liability is limited to the amount they have invested. Personal assets are not at risk if the company faces losses.

Step-by-Step Registration Process LLP Pvt Ltd

While both LLP and Pvt Ltd registrations are done online via the Ministry of Corporate Affairs (MCA) portal, the procedures differ slightly. Here’s a step-by-step comparison.

Registration Process for LLP

- Obtain Digital Signature Certificate (DSC) – Required for all designated partners to sign electronic forms.

- Apply for Designated Partner Identification Number (DPIN) – Mandatory for partners to be identified officially.

- Name Reservation – File through RUN-LLP form. The name should not be identical to an existing business.

- Incorporation Form Filing (FiLLiP) – Submit incorporation details, including LLP agreement and partner details, to MCA.

- Draft and File LLP Agreement – The agreement outlines rights, duties, and obligations of partners. It must be filed within 30 days of incorporation.

Registration Process for Pvt Ltd

- Obtain Digital Signature Certificate (DSC) – For directors to sign documents digitally.

- Apply for Director Identification Number (DIN) – A unique ID for all directors.

- Name Reservation – File Part-A of the SPICe+ (Simplified Proforma for Incorporating Company Electronically) form.

- Prepare Incorporation Documents – Draft Memorandum of Association (MoA) and Articles of Association (AoA).

- File SPICe+ Form – Submit incorporation details, directors, shareholders, and registered office address.

- Receive Certificate of Incorporation – Once approved, the company is legally registered.

Minimum Requirements to Register

| Requirement | LLP | Pvt Ltd |

|---|---|---|

| Minimum Members | 2 partners | 2 directors & 2 shareholders |

| Maximum Members | No limit | 200 shareholders |

| Minimum Capital | No minimum requirement | No minimum requirement |

| Residency | At least 1 partner should be an Indian resident | At least 1 director must be Indian resident |

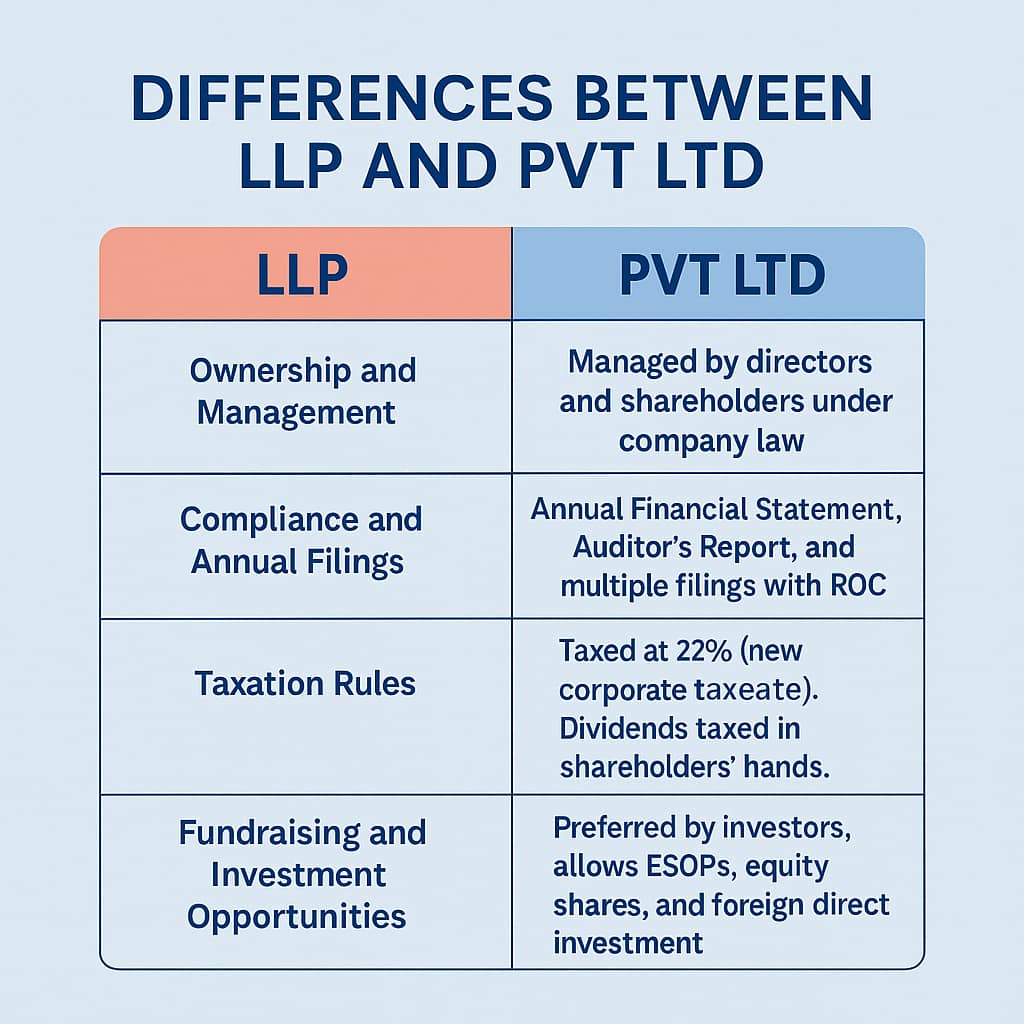

Key Differences Between LLP and Pvt Ltd

Ownership and Management

- LLP: Managed by partners as per the LLP Agreement.

- Pvt Ltd: Managed by directors and shareholders under company law.

Compliance and Annual Filings

- LLP: Annual Statement of Accounts & Solvency + Annual Return.

- Pvt Ltd: Annual Financial Statement, Auditor’s Report, and multiple filings with ROC.

Taxation Rules

- LLP: Taxed at 30% of profits. No dividend distribution tax.

- Pvt Ltd: Taxed at 22% (new corporate tax rate). Dividends taxed in shareholders’ hands.

Fundraising and Investment Opportunities

- LLP: Cannot issue shares, limiting venture capital funding.

- Pvt Ltd: Preferred by investors, allows ESOPs, equity shares, and foreign direct investment.

Advantages of LLP Registration

- Low Compliance Costs: Fewer annual filings compared to Pvt Ltd.

- Flexibility in Management: Partners decide rules via the LLP Agreement.

- No Dividend Tax: Profits can be withdrawn without additional taxation.

Disadvantages of LLP Registration

- Limited Funding Options: Cannot raise equity capital from investors.

- Not Suitable for Startups Aiming to Scale: Venture capitalists prefer Pvt Ltd companies.

Advantages of Pvt Ltd Registration

- Investor-Friendly: Attracts venture capital and private equity funding.

- High Credibility: Recognized as a stable business structure.

- Separate Ownership and Management: Ensures smooth governance.

Disadvantages of Pvt Ltd Registration

- High Compliance Costs: Requires annual audits and multiple filings.

- Complex Exit Procedures: Winding up takes time and involves regulatory approvals.

Which is Better for Startups? LLP or Pvt Ltd?

- If you’re a freelancer, consultant, or running a small family business, an LLP is sufficient.

- If you’re building a scalable startup, seeking funding, or planning to expand globally, a Pvt Ltd company is the right choice.

Cost Comparison: LLP vs Pvt Ltd

| Cost Element | LLP | Pvt Ltd |

|---|---|---|

| Registration Fees | ₹7,000–₹10,000 | ₹10,000–₹15,000 |

| Annual Compliance | ₹10,000–₹15,000 | ₹20,000–₹30,000 |

| Mandatory Audit | Not required until turnover > ₹40 lakh | Mandatory regardless of turnover |

Conversion from LLP to Pvt Ltd

Many entrepreneurs start with an LLP but later switch to a Pvt Ltd company for funding opportunities. Conversion involves:

- Passing a special resolution.

- Applying with MCA through Form URC-1.

- Submitting LLP agreements, NOC from creditors, and incorporation documents.

This process allows businesses to unlock growth potential and attract investors.

Practical Scenarios: Choosing the Right Structure

- Small Professional Firms: LLP is cost-effective and flexible.

- Family Businesses: LLP offers simple compliance.

- Tech Startups: Pvt Ltd is ideal for fundraising and ESOPs.

- Growing SMEs: Pvt Ltd provides credibility and scalability.

FAQs on Registration Process LLP Pvt Ltd

- What is the minimum number of people required for registration?

LLP requires at least 2 partners, while Pvt Ltd needs 2 directors and 2 shareholders. - Is LLP registration cheaper than Pvt Ltd registration?

Yes, LLP has lower registration and compliance costs compared to Pvt Ltd. - Can foreign nationals register an LLP or Pvt Ltd in India?

Yes, foreign nationals can invest, but at least one partner/director must be an Indian resident. - Which has easier compliance—LLP or Pvt Ltd?

LLP has much simpler compliance requirements compared to Pvt Ltd. - Can an LLP raise venture capital funding?

No, investors prefer Pvt Ltd due to equity share options. - Which is easier to close—LLP or Pvt Ltd?

LLP is easier and faster to close than a Pvt Ltd company.

Final Call to Action: Register Your Business Today

Choosing between an LLP and a Pvt Ltd company depends on your business vision, funding needs, and long-term goals. If you’re looking for simplicity and cost-effectiveness, go for an LLP. If you want to build a scalable, investor-ready business, a Pvt Ltd company is the best path forward.

👉 Don’t let confusion delay your business journey. Consult a professional and kickstart the registration process LLP Pvt Ltd today. A strong legal foundation is the first step toward building a successful business.

Consult with our experts at Ravel Corporate Advisors Pvt Ltd

Email: [email protected]

Call/WhatsApp:- +91 9037373311