Table of Contents

Introduction to Post-sale Discounts

Discounts have always been an essential part of business strategies. From promotional campaigns to year-end sales, they help boost demand and reward loyal dealers. However, when it comes to taxation, especially under India’s Goods and Services Tax (GST), the treatment of discounts is far from straightforward.

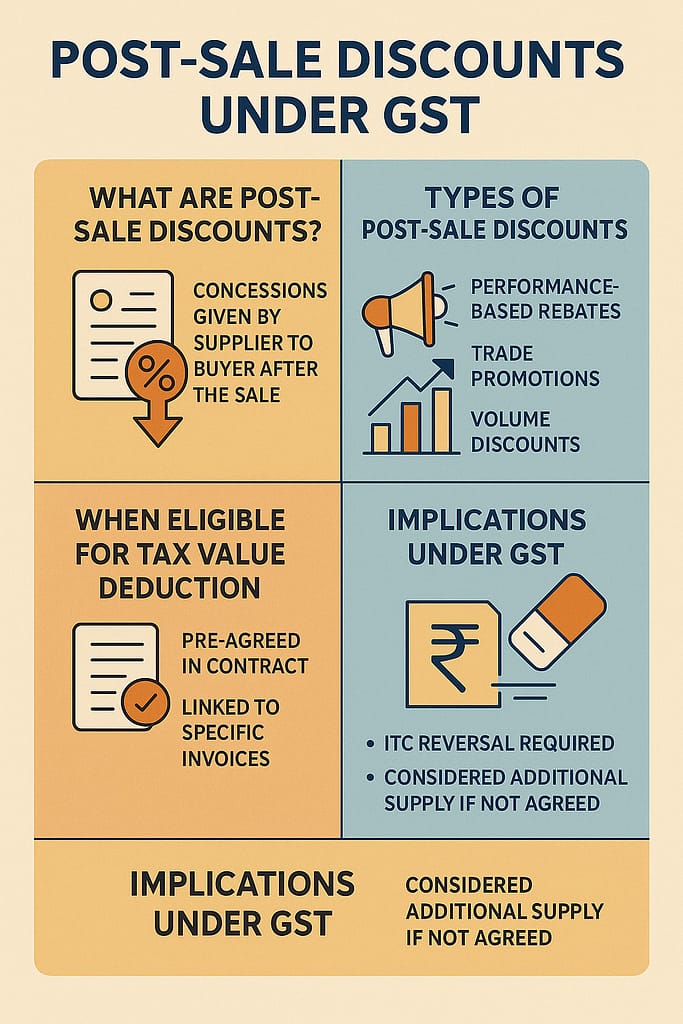

Among the different kinds of discounts, post-sale discounts—often referred to as secondary discounts—have caused considerable confusion for businesses. These are incentives offered after the original sale has been completed. The Central Board of Indirect Taxes and Customs (CBIC) recognized this uncertainty and recently issued Circular No. 251/08/2025-GST, which clarifies how such discounts should be treated.

In this article, we’ll explore the meaning of post-sale discounts, their GST implications, the CBIC’s clarifications, and what businesses must do to remain compliant.

What Are Post-sale Discounts?

Post-sale discounts are concessions given by a supplier to a buyer after the sale has been completed and the tax invoice has already been issued. These are not upfront price reductions but secondary adjustments that often depend on performance, loyalty, or volume-based criteria.

For example:

- A distributor meeting a quarterly sales target may receive a 3% rebate on total purchases.

- A retailer may be given an additional 2% discount if payments are cleared within 10 days.

- A company may offer year-end bonuses to encourage bulk buying.

Difference Between Primary Discounts and Post-sale Discounts

To understand GST implications, it’s important to distinguish between primary discounts (given upfront) and post-sale discounts (granted later).

| Aspect | Primary Discounts | Post-sale Discounts |

|---|---|---|

| Timing | Given at the time of sale, before or at invoice stage | Given after the sale has been completed |

| Invoice Effect | Reflected directly on the tax invoice | Not mentioned in the original invoice |

| GST Impact | Reduces taxable value upfront | Requires separate treatment depending on conditions |

| Examples | Trade discounts, cash discounts | Performance-based rebates, volume discounts |

Legal Background of Post-sale Discounts under GST

The CGST Act, 2017 governs how discounts affect taxable value under GST. According to Section 15(3):

- Discounts given before or at the time of supply and recorded in the invoice can reduce the taxable value.

- Discounts given after supply are deductible only if:

- They are established in terms of a prior agreement,

- They can be linked to specific invoices, and

- The recipient reverses the proportionate Input Tax Credit (ITC).

This means that not all post-sale discounts reduce GST liability. If the conditions aren’t met, they may instead be treated as consideration for a separate supply.

Role of CBIC Circulars in Clarifying Discounts

Circulars issued by the CBIC play a critical role in removing ambiguity. With multiple industries facing litigation and notices on discount-related GST treatment, CBIC stepped in with Circular 251/08/2025, offering much-needed guidance on how to handle secondary or post-sale discounts.

CBIC Circular 251/08/2025 Explained

Objective of the Circular

The circular was issued to resolve doubts about the GST treatment of secondary discounts and post-sale rebates. Businesses frequently faced disputes with tax authorities over whether such discounts should reduce taxable value or be considered as additional consideration.

Key Clarifications Issued

The circular clarifies that:

- If discounts are pre-agreed in contract and are linked to specific invoices, they may be deducted from taxable value.

- If discounts are not pre-agreed or cannot be directly linked to invoices, they will be treated as separate supplies, subject to GST.

- ITC adjustments are mandatory—recipients must reverse ITC proportionate to the discount if the supplier claims reduction in value.

- Promotional schemes offering goods free of cost are not considered discounts but supplies, attracting GST liability.

Types of Post-sale Discounts and Their GST Impact

Secondary Discounts Linked to Performance Targets

- Example: A distributor receives 5% cashback for achieving sales worth ₹50 lakh.

- GST Impact: Allowed as a deduction if pre-agreed; else, taxable.

Trade Promotions and Incentive Schemes

- Example: “Buy 100 units, get 10 free.”

- GST Impact: Free units are considered a separate supply; GST applicable.

Year-end / Volume-based Discounts

- Example: Retailers receive rebates for crossing annual sales targets.

- GST Impact: Deductible if conditions under Section 15(3) are satisfied.

GST Treatment of Post-sale Discounts

When Discounts Are Deductible from Taxable Value

- Must be pre-agreed in a contract.

- Should be linked to a specific invoice.

- Buyer must reverse proportionate ITC.

When Discounts Are Treated as Additional Consideration

- If not pre-agreed, or

- Cannot be matched to invoices, or

- Are disguised as promotional schemes.

Implications on Input Tax Credit (ITC)

- ITC reversal is crucial to avoid double benefits.

- Example: If a supplier claims a reduction in taxable value due to discount, the buyer must proportionally reverse ITC claimed earlier.

Practical Scenarios of Post-sale Discounts

Case 1: Distributor Achieving Sales Target

A distributor receives a year-end rebate for exceeding sales. If this was part of a prior agreement, GST value can be reduced.

Case 2: Discounts Without Prior Agreement

If a company randomly grants discounts after sales, these will not reduce taxable value. Instead, they’ll be taxable as separate consideration.

Case 3: Free Goods or Extra Benefits Offered

Schemes like “Buy 10, get 1 free” are not treated as discounts but as supply of goods at zero consideration, attracting GST.

Challenges Faced by Businesses in GST Compliance

Even with CBIC’s clarifications, businesses often struggle with the practical application of rules regarding post-sale discounts. Let’s break down some of the most common hurdles.

Documentation and Agreement Issues

The GST law requires discounts to be pre-agreed in contracts to qualify for deduction from taxable value. However, in practice:

- Many businesses offer ad-hoc rebates to promote sales.

- Written agreements are either missing or too vague.

- Linking discounts to specific invoices becomes a compliance nightmare.

Without robust documentation, businesses may face disputes with GST officers, leading to litigation.

Risk of ITC Reversal

While suppliers may reduce taxable value, recipients must reverse proportionate ITC. Many businesses fail to do this correctly, which:

- Results in double benefits being claimed.

- Triggers show-cause notices from GST authorities.

- Creates reconciliation issues during audits.

Complexity in Accounting Systems

ERP and billing software often fail to handle post-invoice adjustments efficiently. Companies have to manually adjust credits and reversals, increasing operational complexity and compliance costs.

How to Ensure Compliance with GST Rules on Discounts

To avoid disputes and penalties, businesses must adopt best practices for handling post-sale discounts.

Drafting Proper Agreements with Dealers

- Ensure contracts explicitly mention discount schemes, rebate conditions, and timelines.

- Agreements should clearly link discounts to specific supplies or invoices.

- Avoid vague clauses like “rebates may be granted based on performance.”

Maintaining Transparent Records

- Keep digital and physical documentation of discount offers.

- Record all adjustments in ERP systems for easy tracking.

- Regularly reconcile supplier invoices and ITC claims.

Role of Chartered Accountants and Tax Advisors

- Professional advisors can help draft compliant agreements.

- They ensure correct GST returns filing and ITC reversal.

- They also assist during audits and in responding to departmental queries.

👉 For detailed compliance resources, businesses can refer to the CBIC official portal.

Comparison: Pre-GST vs Post-GST Treatment of Discounts

Understanding how discounts were treated before GST helps appreciate why the CBIC had to step in with clarifications.

How Discounts Were Handled Under VAT/Excise

- In the VAT regime, post-sale discounts often escaped tax scrutiny if they were not part of the original invoice.

- Excise duty was levied on manufacturing value, leaving little scope for discount adjustments.

- Lack of uniformity across states created confusion.

Benefits and Drawbacks of GST Framework

Benefits

- GST law provides clear conditions under Section 15(3) for discount adjustments.

- Uniform national framework reduces state-level discrepancies.

Drawbacks

- High compliance burden for businesses offering multiple discount types.

- Requirement of ITC reversal adds accounting complexity.

- Litigation risk remains due to interpretational issues.

International Practices on Post-sale Discounts

Looking at global taxation systems provides valuable insights for India.

How Other Countries Treat Secondary Discounts

- European Union (EU VAT): Discounts given after supply are allowed if pre-agreed and properly documented.

- United States (Sales Tax): Post-sale rebates often reduce taxable base if tied to original sales contract.

- Australia (GST): Adjustments are made through credit notes, provided conditions are contractually agreed.

Lessons for Indian GST Framework

- Global practices emphasize documentation and transparency.

- India can adopt simplified ITC adjustment mechanisms similar to EU credit-note systems.

- More industry-specific clarifications can help reduce disputes.

FAQs on Post-sale Discounts Under GST

1. What are post-sale discounts in GST?

Post-sale discounts are concessions given by suppliers to buyers after the original sale is completed. These may include performance-based rebates, year-end bonuses, or ad-hoc incentives.

2. Are post-sale discounts taxable under GST?

Yes, unless they meet the conditions under Section 15(3) of the CGST Act (pre-agreed in contract, invoice-linked, and ITC reversal made). Otherwise, they are treated as separate consideration and attract GST.

3. How does ITC apply to secondary discounts?

If the supplier reduces taxable value due to discounts, the recipient must reverse proportionate ITC. Failure to do so may lead to GST notices and penalties.

4. What if discounts are not pre-agreed in contract?

If not pre-agreed, they cannot reduce taxable value. Such discounts are considered independent supplies, and GST must be paid separately.

5. Do promotional schemes count as post-sale discounts?

No. Schemes like “Buy 10, Get 1 Free” are treated as supply of goods at zero consideration, not as discounts. GST is applicable on such supplies.

6. How does CBIC Circular 251/08/2025 affect businesses?

The circular clarifies treatment of post-sale discounts, reducing ambiguity. It emphasizes agreement-based discounts and mandates ITC reversal for compliance.

Conclusion: Navigating Post-sale Discounts Effectively

The concept of post-sale discounts has long been a gray area under GST, causing disputes and confusion for businesses. With the issuance of CBIC Circular 251/08/2025, the government has attempted to bring clarity by distinguishing between eligible discounts that reduce taxable value and those that must be treated as separate supplies.

For businesses, the key takeaway is clear:

- Always document discount schemes upfront in contracts.

- Ensure proper linkage of discounts to invoices.

- Comply with ITC reversal requirements diligently.

By following these steps, companies can minimize litigation risks, maintain GST compliance, and continue to use discounts as a strategic tool to boost sales.

As India’s GST framework evolves, businesses must stay vigilant and adapt their accounting and compliance practices to align with legal requirements. In the end, clarity in contracts and transparency in records are the best shields against tax disputes.