Why the GST Rate Changes September 2025 Matter

The Goods and Services Tax (GST) in India has been through several transformations since its rollout in July 2017. However, the 56th GST Council Meeting, held on September 3, 2025, marks one of the most significant tax reforms in recent years.

The Council announced a major GST rate rationalization, primarily aimed at reducing rates in the food sector and simplifying compliance. These changes, effective from September 22, 2025, are expected to impact millions of businesses across India, from small traders to large FMCG corporations.

This guide provides a comprehensive, step-by-step checklist to help you:

- Update your ERP and accounting systems,

- Rework pricing and MRP,

- Manage Input Tax Credit (ITC),

- Understand invoicing rules under Section 14, and

- Train teams for smooth compliance.

If you’re a tax professional, CFO, business owner, or compliance manager, this article will equip you with everything you need to navigate the GST rate changes September 2025 with confidence.

Table of Contents

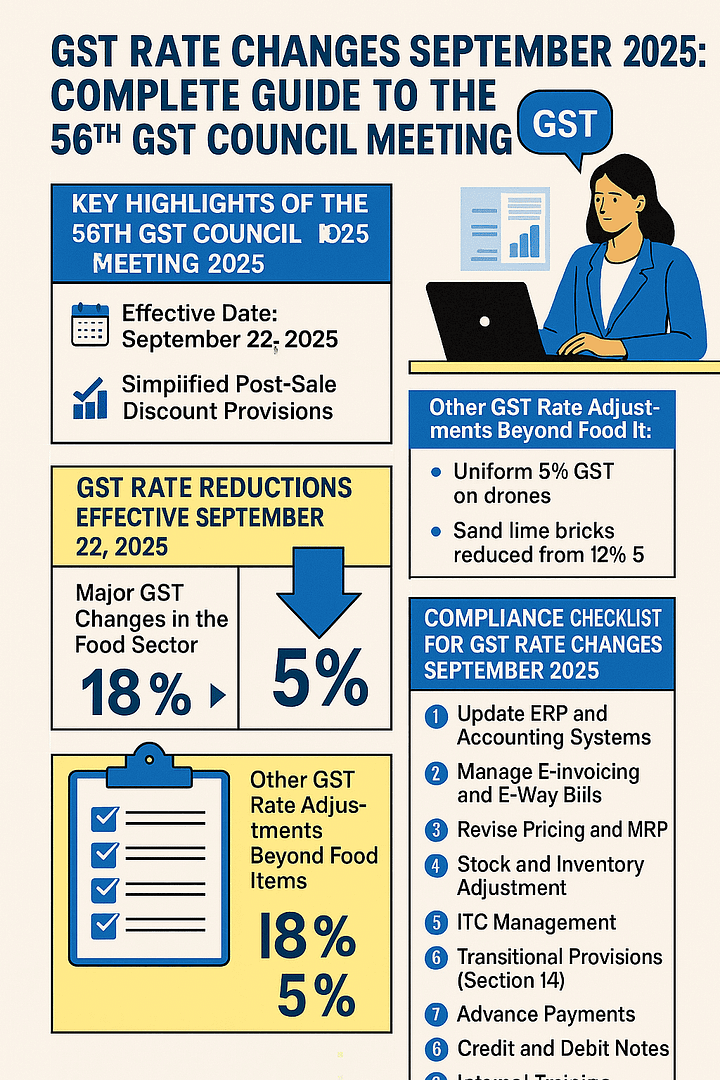

Key Highlights of the 56th GST Council Meeting 2025

The 56th GST Council meeting delivered a range of recommendations. Let’s break down the most important highlights for businesses.

1. Effective Date for Implementation

- September 22, 2025 is the official cut-off date.

- All outward supplies made on or after this date must apply the new GST rates.

📌 Note: Goods like pan masala, gutkha, cigarettes, and unmanufactured tobacco will retain existing rates temporarily until cess-related loan obligations are cleared.

2. GST Rate Reductions in the Food Sector

Perhaps the biggest announcement was the reduction of GST rates from 18% to 5% on a wide variety of food products.

| HSN Code | Description | Old Rate | New Rate (22/09/2025) |

|---|---|---|---|

| 1107 | Malt, roasted or not | 18% | 5% |

| 1704 | Sugar confectionery (select types) | 18% | 5% |

| 1806 | Chocolates and cocoa-based items | 18% | 5% |

| 1901 | Malt extract, food preps of flour, groats | 18% | 5% |

| 1904 | Cereal flakes (cornflakes, etc.) | 18% | 5% |

| 1905 | Pastry, cakes, biscuits, bakers’ wares | 18% | 5% |

| 2101 | Coffee, tea, mate extracts | 18% | 5% |

| 2104 | Soups and broths | 18% | 5% |

| 2105 | Ice cream and edible ice | 18% | 5% |

| 2106 | Other food preparations (NES) | 18% | 5% |

| 2201 | Waters (aerated/mineral, no sugar) | 18% | 5% |

| 2202 99 | Plant-based milk drinks | 18% | 5% |

This reduction will significantly reduce consumer prices, but businesses must ensure pricing compliance under anti-profiteering provisions.

3. Other Notable GST Changes

- Post-Sale Discounts: Simplified provisions under Section 15(3)(b) allow businesses to exclude discounts from the value of supply without linking them to pre-agreed invoices.

- Uniform GST Rate for Drones: All drones will now attract a flat 5% rate (previously 5%, 18%, or 28%).

- Sand Lime Bricks: GST reduced from 12% to 5% (while regular bricks’ scheme remains unchanged).

Compliance Checklist for GST Rate Changes September 2025

To prepare for September 22, businesses must follow this 12-step checklist.

Step 1: Update ERP and Accounting Systems

- Configure new tax rate masters in ERP platforms like SAP, Oracle, or Tally.

- Map all relevant HSN and SAC codes to the new 5% rate.

- Test system-generated invoices to avoid errors.

- Retailers must update POS systems to prevent over/under charging.

Step 2: Manage E-Invoicing and E-Way Bills

- Ensure API providers update their systems.

- Verify that invoice uploads to government portals reflect the revised tax rates.

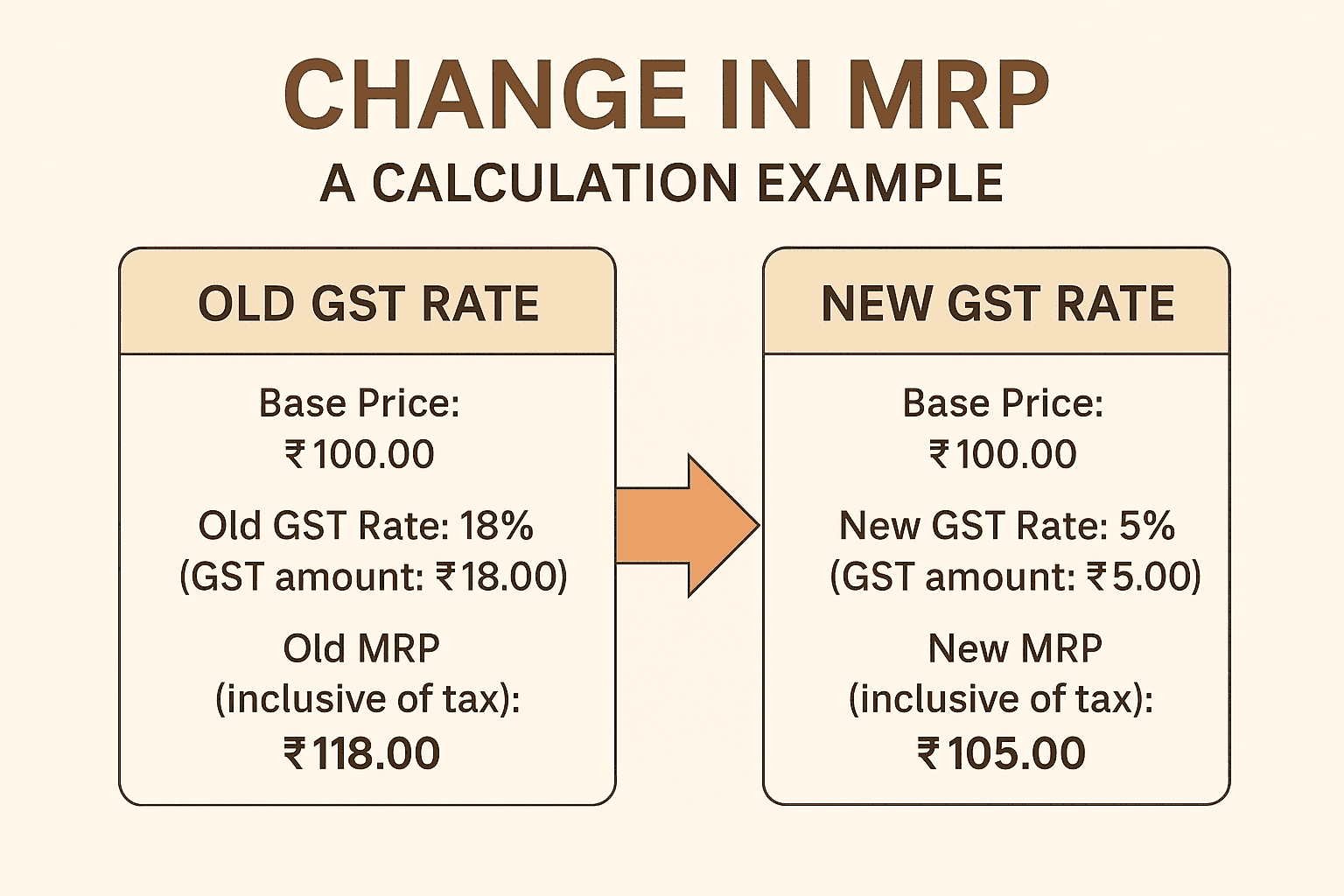

Step 3: Revise Pricing and MRP

- Businesses must pass on tax benefits to customers as per anti-profiteering guidelines.

- Update MRPs on packaging where required.

- For existing stock, issue revised price lists to dealers instead of recalling products.

Step 4: Stock and Inventory Adjustments

- All supplies after September 22 must apply the new rate, regardless of procurement date.

- Carefully tag pre-change stock to avoid confusion.

Step 5: ITC Management

- ITC on past procurements (at 18%) remains claimable under Section 16.

- Utilize accumulated ITC freely for future liabilities under Section 49(4).

- Reverse ITC for exempt supplies using Rule 42/43.

- Inverted Duty Refunds: Not applicable when rate change alone creates the mismatch.

Step 6: Transitional Provisions (Section 14)

Correct GST rate depends on time of supply.

| Scenario | Supply Date | Invoice Date | Payment Date | Applicable Rate |

|---|---|---|---|---|

| 1 | Before 22/09 | Before 22/09 | After 22/09 | Old (18%) |

| 2 | Before 22/09 | After 22/09 | After 22/09 | New (5%) |

| 3 | Before 22/09 | After 22/09 | Before 22/09 | Old (18%) |

| 4 | After 22/09 | After 22/09 | Before 22/09 | New (5%) |

| 5 | After 22/09 | Before 22/09 | After 22/09 | New (5%) |

| 6 | After 22/09 | Before 22/09 | Before 22/09 | Old (18%) |

Step 7: Advance Payments

- Goods: Rate on invoice date prevails (since advances not taxed).

- Services: Rate depends on time of supply provisions.

Step 8: Credit and Debit Notes

- If goods sold earlier at 18% are returned later, issue credit notes at 18%.

- Debit notes must always match original tax liability.

Step 9: Internal Training

- Train sales, accounts, and logistics teams on new GST rules.

- Ensure procurement teams validate vendor invoices.

Step 10: Vendor and Customer Communication

- Notify vendors to avoid ITC mismatches.

- Inform customers of new MRPs to maintain transparency.

Step 11: Compliance with Anti-Profiteering

- Maintain documentation showing price reductions passed on to consumers.

- Prepare for potential audits under National Anti-Profiteering Authority (NAA).

Step 12: Legal and Professional Consultation

- Consult tax advisors for industry-specific guidance.

- Stay updated via official GST notifications and CBIC circulars.

GST FAQs for September 2025 Rate Changes

Q1. I supplied goods on September 20 but invoiced on September 24. Which GST rate applies?

➡️ As per Section 14, since the invoice is after the change, the new 5% rate applies.

Q2. Can I use ITC accumulated at 18% to pay new 5% liabilities?

➡️ Yes. ITC is fungible and can be used against any GST liability under Section 49(4).

Q3. What happens to ITC if my product becomes exempt?

➡️ ITC reversal is mandatory under Rule 42/43 for stock related to exempt supplies.

Q4. Do I need to re-label all products with new MRPs?

➡️ No, but businesses must issue revised price lists to dealers and ensure compliance at retail level.

Q5. Will refunds be available due to inverted duty structure (18% inputs vs 5% output)?

➡️ No. Refunds are not applicable when the mismatch arises purely from a rate change over time.

Q6. How should businesses handle advances received before September 22?

➡️ For goods, advances are not taxed. For services, time of supply rules determine the applicable rate.

Q7. Are e-commerce sellers impacted by these changes?

➡️ Yes, platforms must update GST rate mappings in their systems to avoid compliance mismatches.

Q8. What penalties apply for wrong GST rates after September 22?

➡️ Incorrect invoicing can lead to interest, penalties, and ITC disputes, making system updates critical.

Conclusion: Preparing Your Business for GST Rate Changes September 2025

The GST rate changes September 2025 represent a massive shift in India’s indirect tax system. While the reduced rates will benefit consumers, businesses must act quickly to ensure compliance.

By following the 12-step compliance checklist, updating systems, training teams, and maintaining transparency with customers, businesses can navigate this transition smoothly.

👉 The deadline is September 22, 2025. Don’t wait—start implementing these changes now to avoid last-minute disruptions.

For more updates, refer to the official GST portal: CBIC GST Updates.