Decoding the 56th GST Council Meeting: A New Era for Indian Taxation

The 56th GST Council Meeting, held on September 3, 2025, has ushered in a new era of GST reforms. Far beyond routine rate adjustments, this meeting delivered a comprehensive overhaul of India’s indirect tax framework. With the changes set to take effect from September 22, 2025, businesses across the country must prepare for wide-ranging impacts on pricing, compliance, and operational processes.

This article combines the big-picture reforms announced by the Council with a practical guide to accounting, compliance, and ITC treatment, helping businesses transition smoothly.

Table of Contents

1. Introduction: The Dawn of ‘Simple Tax’

For years, GST has been criticized for its multi-layered rate structure and frequent disputes over classification. The Council has now taken bold steps to simplify:

- Merit Rate: 5% – for essential goods & services, items of mass consumption.

- Standard Rate: 18% – for most other goods & services.

- Special De-Merit Rate: 40% – for select luxury/sin goods.

This rationalization (from four slabs into two main rates) is expected to:

- Reduce classification disputes.

- Improve ease of compliance.

- Boost consumption by lowering prices.

Effective September 22, 2025, this is more than a cosmetic change—it marks a structural shift in India’s indirect tax policy.

2. The Big Shift: Goods Becoming Exempt (NIL Rated)

Several daily-use and critical goods/services have been moved to zero GST (NIL rate), including:

- UHT milk

- Packaged & labelled paneer

- All Indian breads (chapati, roti, parotta, etc.)

- Individual life and health insurance policies (with reinsurance)

- 36 specified life-saving drugs & medicines

Impact on Input Tax Credit (ITC)

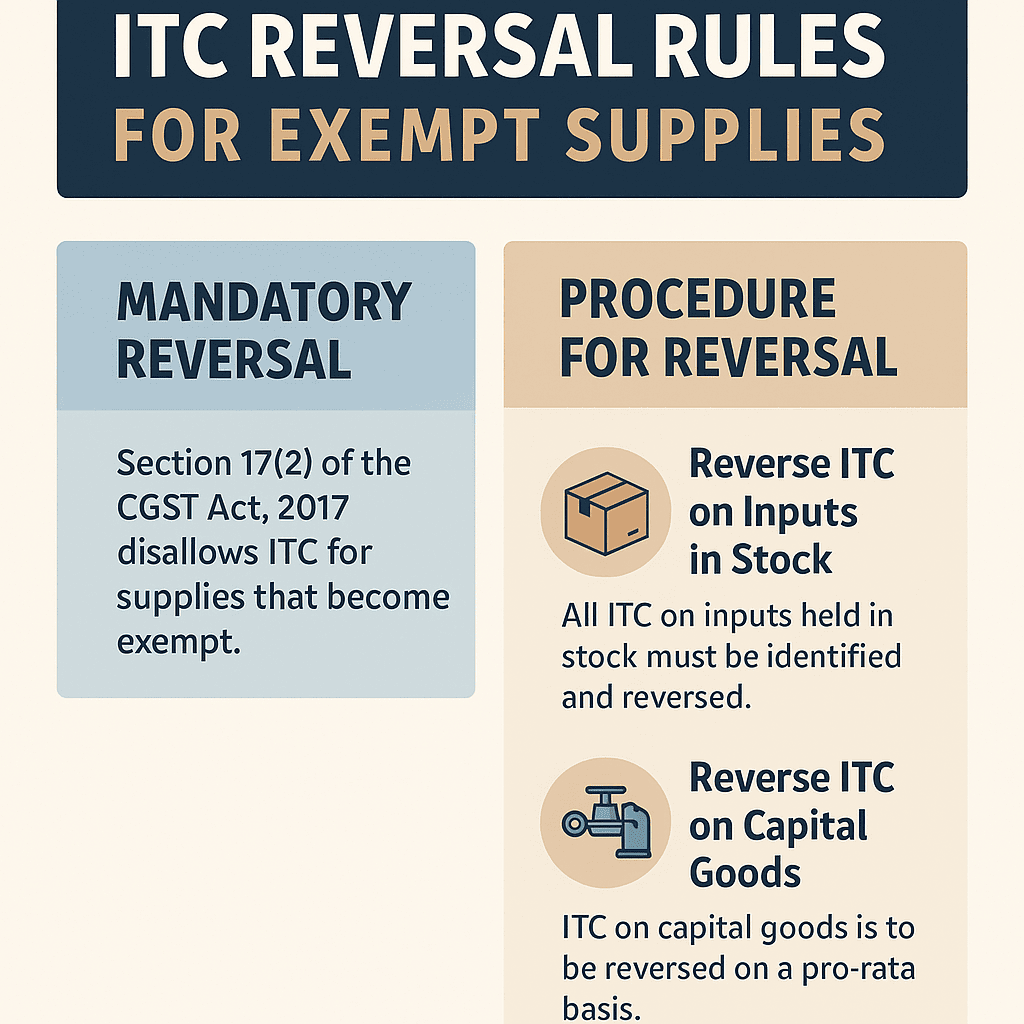

This is where things get tricky.

Under Section 17(2) of the CGST Act, 2017, once a supply becomes exempt, businesses must reverse ITC on:

- Inputs in stock (raw material, semi-finished, finished goods).

- Input services.

- Capital goods (on a pro-rata basis).

Example: A paneer manufacturer can no longer claim ITC on milk, packaging material, or machinery maintenance costs.

3. Treatment of ITC: Two Scenarios

Article 2 adds clarity with practical rules:

Scenario A: GST Rate Reduced (e.g., 18% → 5%)

- ✅ ITC already claimed remains valid.

- ✅ No reversal required.

- ✅ ITC can be utilized against new lower output liability.

- ⚠️ Risk of ITC accumulation if input tax > output tax.

Scenario B: Supply Becomes Exempt (e.g., 5% → NIL)

- ❌ Mandatory ITC reversal.

- Rule 42 & 43 compliance:

- Reverse ITC on all inputs in stock (as of 21-Sep-2025).

- Reverse ITC on capital goods proportionate to remaining useful life (5 years).

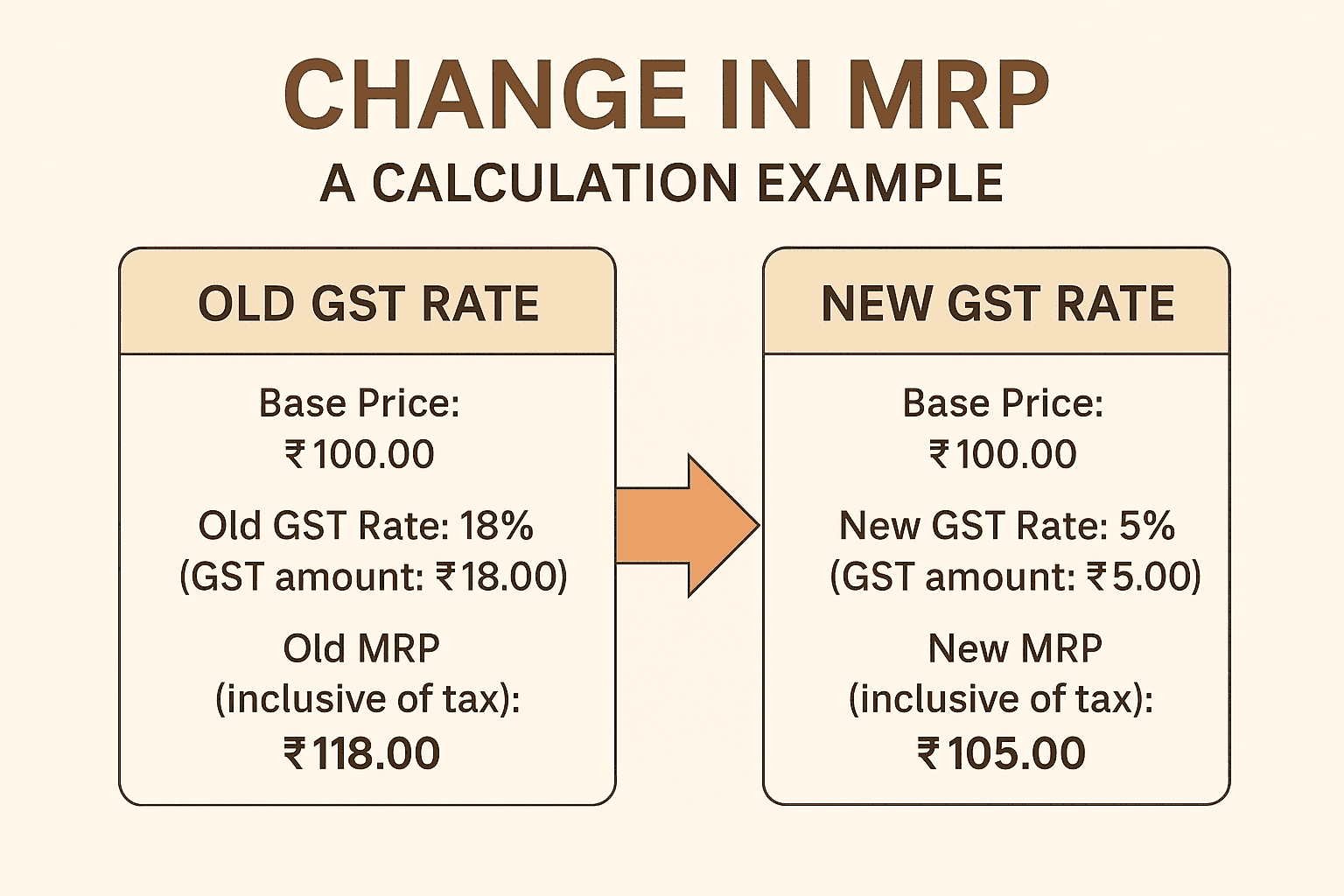

4. Navigating the Change in MRP

The law requires businesses to pass on tax benefits to consumers under Section 171 (Anti-profiteering).

Example of Recalculation:

- Base Price = ₹100

- Old GST @18% = ₹18 → MRP = ₹118

- New GST @5% = ₹5 → MRP = ₹105

Businesses must issue revised MRPs through re-stickering, updated billing, or formal notifications to distributors/retailers. Failure attracts penalties.

5. Navigating Rate Reductions: Sectoral Impact

From 18%/12% → 5%

- Food: chocolates, noodles, pasta, biscuits, ice cream, ghee, butter, sauces.

- FMCG: hair oil, soaps, shampoos, toothpaste, bicycles.

- Agriculture/Industry: tractors, fertilizers, handicrafts, acids, leather goods.

- Healthcare: medicines, diagnostic kits, glucometers.

- Services: hotels (≤₹7,500/day), gyms, salons.

From 28% → 18%

- Auto sector: small cars, motorcycles ≤350CC, buses, ambulances, auto parts.

- Consumer durables: ACs, TVs (all sizes now 18%), dishwashers.

- Construction: cement.

This wide-ranging reduction is expected to boost demand in FMCG, auto, real estate, and healthcare.

6. Determining the Time of Supply (Section 14)

This is the most crucial provision for businesses during the transition.

It depends on the timing of:

- Supply of goods/services

- Issuance of invoice

- Receipt of payment

Detailed Table (From Article 2)

| Scenario | Supply Date | Invoice Date | Payment Date | Applicable Rate | Why |

|---|---|---|---|---|---|

| 1 | Before 22-Sep | Before 22-Sep | Before/After 22-Sep | Old Rate | Supply + Invoice before change |

| 2 | Before 22-Sep | On/After 22-Sep | On/After 22-Sep | New Rate | Invoice after change |

| 3 | Before 22-Sep | On/After 22-Sep | Before 22-Sep | Old Rate | Supply + Payment before change |

| 4 | On/After 22-Sep | Before 22-Sep | Before 22-Sep | Old Rate | Invoice + Payment before change |

| 5 | On/After 22-Sep | On/After 22-Sep | Before 22-Sep | New Rate | Supply + Invoice after change |

| 6 | On/After 22-Sep | Before 22-Sep | On/After 22-Sep | New Rate | Supply + Payment after change |

This ensures clarity in applying old vs. new rates.

7. Compliance & Accounting Adjustments

Transitioning isn’t just legal—it’s operational. Businesses must:

- Update ERP/Accounting Systems:

- Create new ledgers for revised tax rates.

- Deactivate old ledgers for new transactions.

- Map HSN/SAC codes correctly.

- Modify Invoice Templates: All invoices post-22-Sep must reflect new rates.

- Train Staff: Ensure accountants, sales teams, and billing staff apply correct rates.

- Inventory Management: Separate pre-change stock from post-change stock to avoid errors.

This is resource-intensive but essential for error-free compliance.

8. Major Legal & Procedural Overhauls

Beyond rates, structural amendments include:

- Post-Sale Discounts Simplified:

- Section 15(3)(b)(i) omitted.

- Now discounts can be passed via credit notes under Section 34.

- Condition: recipient must reverse proportionate ITC.

- Boost for Service Exporters:

- Section 13(8)(b) (intermediary services) omitted.

- Place of supply = recipient’s location.

- Makes Indian intermediary services eligible as exports.

- Empowering Small Exporters:

- Refund threshold under Section 54(14) removed.

- Easier cash flow for SMEs using e-commerce, courier, postal exports.

- Correction of Inverted Duty Structure (IDS):

- Textiles: fibre (18% → 5%), yarn (12% → 5%).

- Fertilizers: acids & ammonia (18% → 5%).

9. Weighing the Outcomes

Advantages

- Simpler 2-rate structure.

- Lower consumer prices → demand boost.

- Clearer laws → less litigation.

- IDS correction improves cash flow in textiles & fertilizers.

Disadvantages

- One-time compliance burden (ERP, invoices, repricing).

- ITC loss on exempted goods increases costs.

- Stock segregation challenges.

- Short-term dip in government revenues.

10. Frequently Asked Questions (FAQs)

Q1: I purchased stock at 18%, but GST is now 5%. What to do?

A: Sell at new MRP (with 5%). You retain ITC at 18%.

Q2: I provide back-office support to a US client. Am I now exempt from GST?

A: Yes. With Section 13(8)(b) omitted, place of supply is US. Your service qualifies as export.

Q3: My invoice was raised before 22-Sep, but supply is after. Which rate applies?

A: Old rate applies (invoice date governs).

Q4: Can I offer year-end discounts without prior agreement?

A: Yes. Issue credit notes under Section 34. Recipient must reverse ITC.

Q5: What happens to ITC on machinery for UHT milk?

A: Reverse ITC proportionately for remaining useful life (5 years rule).

11. Conclusion: The Road Ahead

The 56th GST Council Meeting represents a strategic shift in India’s taxation model:

- A simpler, two-rate system.

- Relief for consumers.

- Streamlined legal framework for businesses.

- Boost for exports and key sectors.

Yes, the transition will demand ERP updates, ITC reversals, price recalibrations, and staff training. But the long-term gains—clarity, efficiency, growth—far outweigh the short-term challenges.

India’s GST is finally evolving from a complex compliance regime into a truly business- and citizen-friendly system.