Table of Contents

Introduction to GST 2.0 Reforms

The Goods and Services Tax (GST) was introduced in India in 2017 to simplify the indirect tax system. Over the years, GST has gone through multiple changes to improve efficiency and fairness. In September 2025, during the 56th GST Council meeting, a major revamp known as GST 2.0 reforms was announced.

These reforms are seen as a historic step to make India’s tax system more transparent, predictable, and business-friendly. For ordinary citizens, it means cheaper goods and services in many sectors, while for businesses, it promises simpler compliance and fewer disputes. But like every big reform, it also comes with challenges and concerns.

This blog will walk you through everything you need to know about GST 2.0 reforms—from its highlights to its social and economic impact, advantages, disadvantages, and the road ahead.

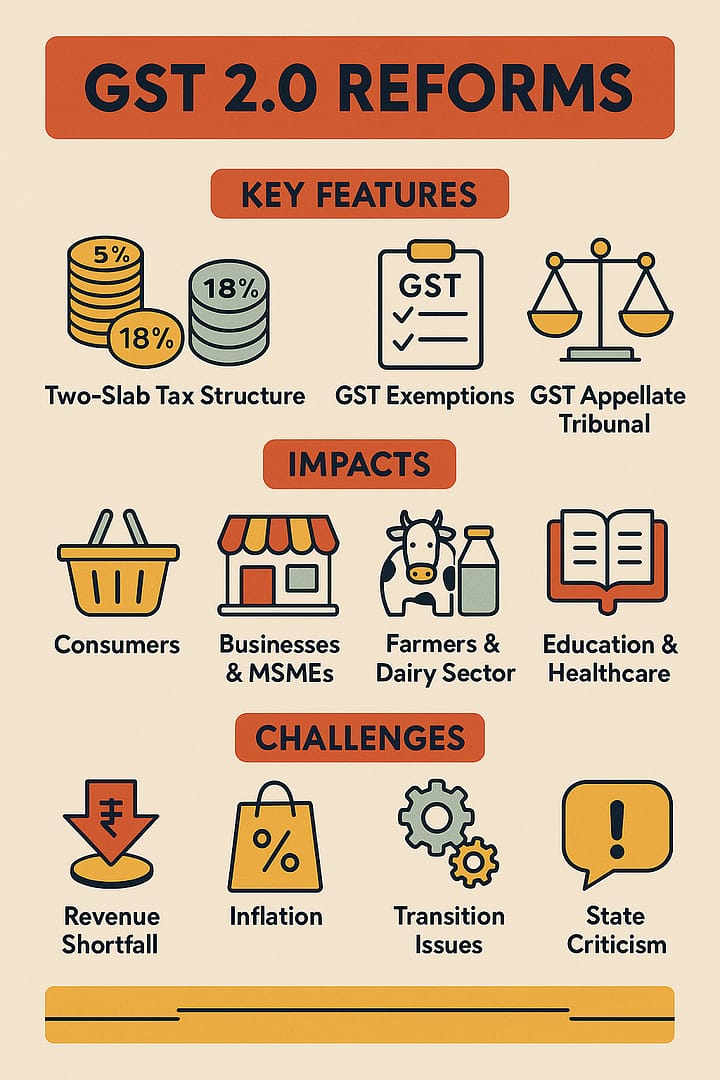

What are GST 2.0 Reforms?

GST 2.0 reforms are a major restructuring of India’s GST system aimed at reducing complexity, easing compliance, and boosting consumption.

The reforms bring in a two-slab tax structure, exemptions for essential services, creation of a new dispute resolution mechanism, and several compliance relaxations. Together, these changes aim to strengthen the tax system and make it more inclusive for businesses, farmers, students, and consumers.

In simple words, GST 2.0 is a makeover of India’s indirect tax system to address long-standing concerns and to give it a fresh start.

Historical Background of GST in India

Before GST, India had a messy web of taxes like VAT, excise, service tax, and entry tax. GST was introduced in July 2017 to replace this system with a single nationwide tax. Initially, GST had multiple tax slabs like 5%, 12%, 18%, and 28%. While it was a big achievement, it also brought confusion due to frequent rate changes and disputes between businesses and tax authorities.

Over time, industries, economists, and common people demanded a simpler system. After years of discussions, the 56th GST Council meeting in 2025 paved the way for GST 2.0 reforms, marking a turning point in India’s tax history.

Key Highlights of GST 2.0 Reforms

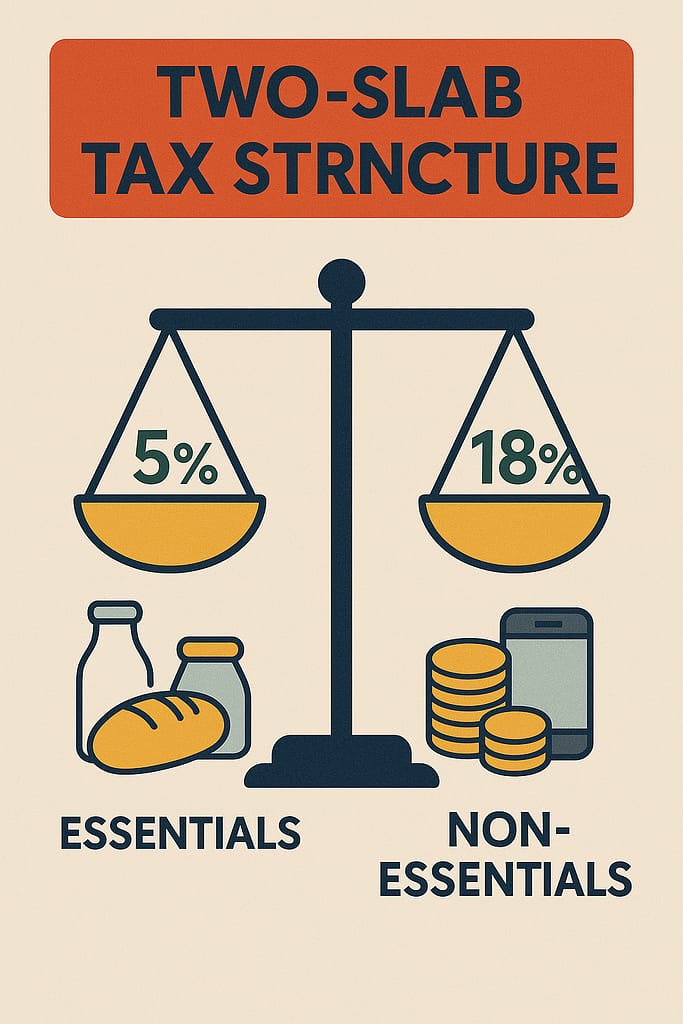

Introduction of the Two-Slab Structure

One of the biggest announcements is the move to a two-slab GST system—5% and 18%. Earlier, there were four major slabs (5%, 12%, 18%, and 28%) plus special cesses. This created confusion for both businesses and consumers. By moving to two main slabs, the government has simplified the structure.

This change is expected to reduce classification disputes, where businesses fought over whether an item should be taxed at 12% or 18%. Now, the decision is much clearer—either it falls into the lower slab (5%) or the higher slab (18%).

GST Exemptions for Essential Sectors

Several essential goods and services are now exempt under GST 2.0. These include:

- Health and life insurance – making medical care more affordable.

- Education-related items like stationery and maps – easing the burden on parents and students.

- Dairy and agricultural products – reducing costs for farmers and households.

These exemptions directly benefit common people by reducing day-to-day expenses.

Introduction of GST Appellate Tribunal (GSTAT)

Disputes have been a big headache in GST. Businesses often had to fight long legal battles to resolve tax-related issues. With GST 2.0, a dedicated GST Appellate Tribunal (GSTAT) has been set up to resolve disputes faster.

This means businesses no longer need to go through lengthy court procedures, saving time and money.

Changes in Compliance Rules

For small businesses and MSMEs, compliance has always been a challenge. GST 2.0 introduces several changes to make life easier:

- Simplified filing process

- Fewer returns required

- Digitalization of compliance with easy-to-use online platforms

This will reduce paperwork, cut compliance costs, and allow businesses to focus on growth rather than tax headaches.

Positive Impacts of GST 2.0 Reforms

The reforms are expected to have several benefits for different groups in society.

Benefits for Consumers

With the reduction in slabs and exemptions, many products are now cheaper. Essential items like insurance and education goods are tax-free, reducing household expenses. Consumers will also benefit from fewer hidden costs as the system becomes more transparent.

Benefits for Businesses & MSMEs

Small and medium enterprises often struggled with compliance. GST 2.0 makes filing easier, cuts unnecessary documentation, and reduces disputes. This means businesses can save both time and money, allowing them to focus more on expansion and innovation.

Benefits for Farmers & Dairy Sector

The government has given special attention to agriculture and dairy. Tax cuts in these sectors mean lower input costs for farmers. For dairy producers, exemptions make milk and milk-based products more affordable, which directly benefits both farmers and consumers.

Benefits for Education & Healthcare

By exempting key education materials and insurance premiums, GST 2.0 makes these sectors more accessible. Families will spend less on schooling and healthcare, leading to broader social welfare benefits.

Challenges and Disadvantages of GST 2.0 Reforms

While the reforms bring many positives, there are also concerns and challenges.

Revenue Shortfall Concerns

The government may face reduced tax collections due to exemptions and rate cuts. This could impact its ability to spend on public infrastructure and welfare schemes.

Risk of Inflation in Certain Sectors

Though many goods will get cheaper, some sectors may see higher taxes due to realignment into the two slabs. This could lead to inflation in specific industries like automobiles and luxury goods.

Transitional Challenges for Businesses

Switching from the old multi-slab system to the new two-slab structure will take time. Businesses need to update billing systems, software, and compliance procedures. This may cause short-term confusion and extra costs.

Criticism from States

Some states are worried about losing fiscal autonomy under GST 2.0. They fear that exemptions and lower rates may reduce their share of revenue, putting pressure on state budgets.

Economic Impact of GST 2.0

Economists believe GST 2.0 can add ₹20 lakh crore to India’s GDP over time. The simplified tax system is expected to boost consumption, encourage investment, and attract foreign businesses. A predictable tax environment also improves investor confidence, making India a more attractive destination for global companies.

Social Impact of GST 2.0 Reforms

The reforms are expected to ease the financial burden on middle-class families, farmers, and students. Cheaper insurance, lower education costs, and reduced prices of essential goods all improve social welfare.

On the other hand, higher taxes on luxury items may affect the upper-income class, but this is in line with the government’s aim to create a more inclusive tax system.

GST 2.0 vs. Previous GST Framework

| Aspect | Old GST System | GST 2.0 Reforms |

|---|---|---|

| Tax Slabs | 4 slabs (5%, 12%, 18%, 28%) | 2 slabs (5% and 18%) |

| Exemptions | Limited | Expanded (health, education, dairy, etc.) |

| Dispute Resolution | Courts & authorities | GSTAT tribunal |

| Compliance | Complicated, multiple filings | Simplified, digital-first |

| Impact on Consumers | Mixed (some goods cheaper, some expensive) | Clearer benefits, essential goods cheaper |

Global Comparison: How India’s GST 2.0 Matches with Other Nations

Countries like Australia and Canada already have simplified GST or VAT systems with fewer slabs. India’s earlier multi-slab system was often criticized as complicated. With GST 2.0, India has moved closer to global best practices, which enhances ease of doing business and boosts competitiveness.

Implementation Timeline for GST 2.0

- Announcement: 56th GST Council meeting, September 2025

- Effective Date: September 22, 2025 (phased roll-out)

- Transition Period: Businesses given time till March 2026 to fully adapt

- Full Implementation: April 2026 onward

Future of GST in India Beyond 2.0

Experts believe GST 2.0 is not the end but a stepping stone to GST 3.0. The future may include a single tax slab, further digitalization, AI-driven compliance, and even integration with global tax frameworks.

India’s long-term goal is to make GST a world-class, simple, and transparent tax system.

Frequently Asked Questions (FAQs)

1. When will GST 2.0 reforms come into effect?

The reforms will be implemented in phases starting from September 22, 2025, with complete transition expected by April 2026.

2. What is the new two-slab structure?

GST 2.0 has only two main tax slabs—5% and 18%, replacing the earlier 4-slab system.

3. Which sectors benefit most from GST 2.0?

Healthcare, education, insurance, agriculture, dairy, and MSMEs are among the biggest beneficiaries.

4. Are there any items still taxed at higher rates?

Yes, certain demerit or luxury goods may still attract a 40% sin tax or cess, such as tobacco and luxury cars.

5. How will GST 2.0 affect small businesses?

Small businesses will benefit from simplified compliance, fewer returns, and faster dispute resolution through GSTAT.

6. Will GST 2.0 increase or decrease household expenses?

For most households, expenses will decrease due to exemptions on insurance, education, and essential goods. However, luxury goods may become more expensive.

Conclusion: The Road Ahead for GST 2.0 Reforms

The GST 2.0 reforms mark a turning point in India’s economic journey. By simplifying the tax system, reducing rates, and exempting essentials, the government has made life easier for both citizens and businesses. While there are challenges like revenue shortfall and transitional issues, the long-term benefits outweigh the drawbacks.

If implemented effectively, GST 2.0 can drive higher economic growth, social equality, and ease of doing business. It is a big step towards making India’s tax system future-ready and globally competitive.