Corporate India just got a breather! On 29th September 2025, the Ministry of Corporate Affairs (MCA), Government of India issued General Circular No. 04/2025, granting extra time for directors to file e-form DIR-3-KYC and web-form DIR-3-KYC-WEB without incurring additional fees.

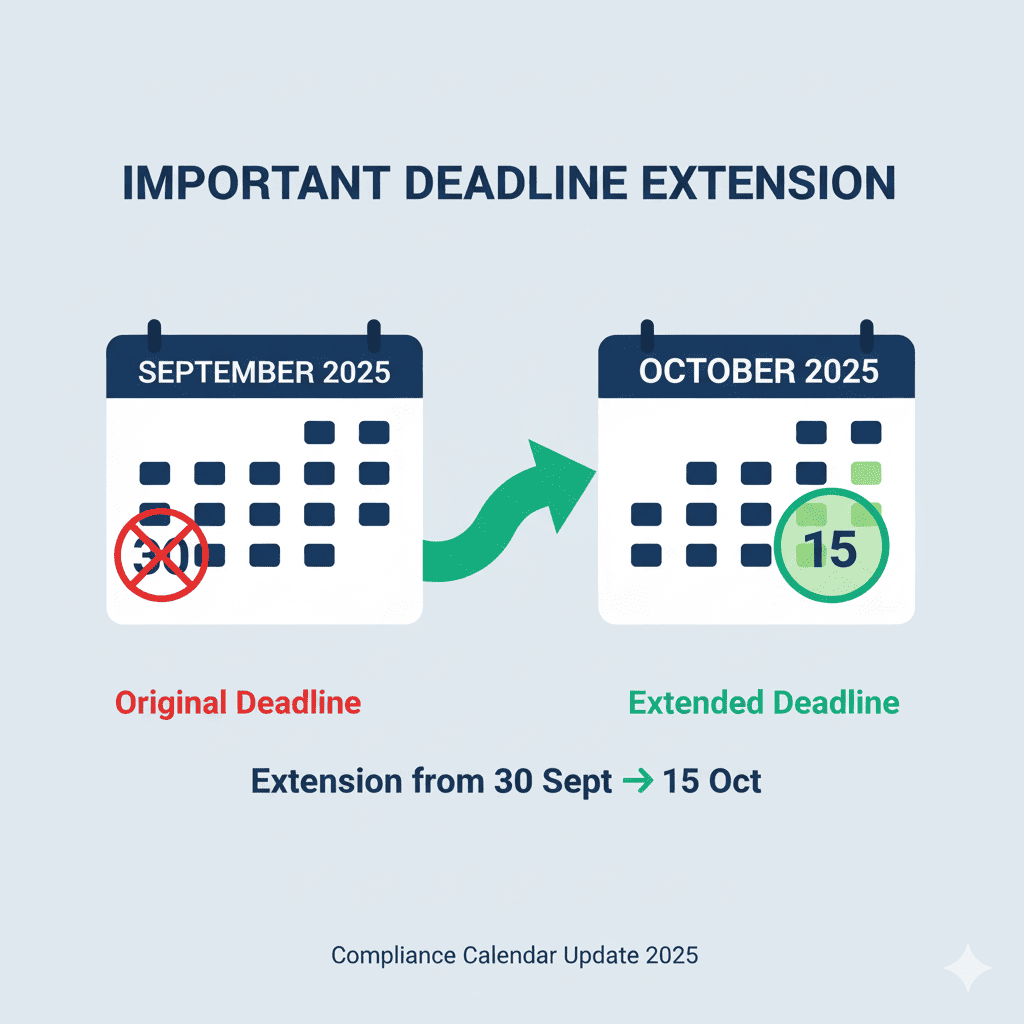

The extension moves the original deadline of 30th September 2025 to 15th October 2025. This update is a welcome relief for directors and companies struggling to complete compliance formalities in time.

In this article, we’ll break down everything you need to know: the circular’s details, its implications, filing processes, penalties for missing deadlines, and an expert’s view on why directors should act fast.

Table of Contents

Introduction to the MCA Circular 04/2025

The MCA frequently issues circulars to simplify compliance and give companies flexibility in meeting deadlines. The latest circular, issued from Shastri Bhawan, New Delhi, responds to repeated requests from stakeholders for more time to complete mandatory KYC filings.

By extending the DIR-3-KYC and DIR-3-KYC-WEB filing deadline, the MCA aims to reduce late fees burden and ensure that directors remain compliant without unnecessary financial strain.

Background of DIR-3-KYC and DIR-3-KYC-WEB

What is DIR-3-KYC?

The DIR-3-KYC form is an annual compliance requirement for directors in India. It ensures that:

- The Director Identification Number (DIN) is valid and active.

- The director’s contact information is accurate.

- MCA’s database stays updated for transparency and accountability.

What is DIR-3-KYC-WEB?

For directors who have already submitted their KYC once via DIR-3-KYC, subsequent updates can be done through the DIR-3-KYC-WEB, a simplified web-based form.

This makes annual compliance easier, quicker, and paperless.

Key Highlights of the MCA Circular

Official Circular Details

- Circular No.: 04/2025

- Issued by: Ministry of Corporate Affairs

- Date: 29th September 2025

- Subject: Extension of time for filing e-form DIR-3-KYC and web-form DIR-3-KYC-WEB without fees.

New Deadline Announced

- Old Deadline: 30th September 2025

- New Deadline: 15th October 2025

- Relief: No additional fees payable till extended date.

Why MCA Extended the Deadline

Stakeholder Suggestions

MCA received multiple requests from directors, corporates, and compliance professionals to push the deadline. The ministry considered these practical challenges and agreed to extend the date.

Ease of Compliance

The extension provides breathing space for:

- Directors who missed the September deadline.

- Companies struggling with filing bottlenecks.

- Compliance professionals managing bulk filings.

Applicability of the Circular

Who Needs to File DIR-3-KYC?

Every individual holding a DIN (Director Identification Number) as of 31st March of a financial year must file KYC annually.

Companies & Directors Covered

- Private Limited Companies

- Public Limited Companies

- Section 8 (Non-profit) Companies

- LLPs (where partners hold DINs)

Step-by-Step Process for Filing DIR-3-KYC

Documents Required

- PAN Card

- Aadhaar Card

- Passport (for foreign nationals)

- Mobile & Email OTP verification

Filing via e-form DIR-3-KYC

- Prepare e-form from MCA portal.

- Attach self-attested documents.

- Download e-form from MCA portal.

- Get form digitally signed and certified by a professional (CA/CS/CMA).

- Upload on MCA portal.

Filing via web-form DIR-3-KYC-WEB

- Login to MCA portal.

- Enter DIN and OTP verification.

- Submit online – no documents needed if details remain unchanged.

Penalties for Non-Compliance

Late Fee Structure

If not filed by 15th October 2025:

- Directors must pay ₹5,000 as late filing fee.

Consequences of Inactive DIN

- DIN status marked “Deactivated due to non-filing of DIR-3-KYC”.

- Directors cannot sign filings, resolutions, or official documents.

- May attract further penalties and compliance delays.

Impact on Directors and Companies

Compliance Relief for Directors

The extension reduces stress and financial penalties for thousands of directors.

Benefits for Corporates

- Avoid disruption in board approvals.

- Maintain smooth ROC compliance.

- Prevent governance risks due to inactive DINs.

Expert Corporate Consultant’s View

Why Timely Filing is Crucial

Though the deadline has been extended, directors must not wait until the last day. System overload and technical glitches often occur near the deadline.

Best Practices for Compliance

- Maintain updated digital signatures.

- Keep KYC documents handy.

- File early to avoid MCA portal congestion.

Timeline Comparison: Previous vs Extended Deadline

| Particulars | Earlier Date | Extended Date |

|---|---|---|

| Filing Deadline | 30th September 2025 | 15th October 2025 |

| Fee (till deadline) | Nil | Nil |

| Late Fee (after deadline) | ₹5,000 | ₹5,000 |

FAQs on MCA Circular 04/2025

Q1. What is the new due date for DIR-3-KYC filing in 2025?

The due date is extended to 15th October 2025.

Q2. Will late fees apply if I file by 15th October 2025?

No, filings made till 15th October 2025 will be fee-free.

Q3. What happens if I don’t file even by the extended date?

You’ll need to pay ₹5,000 late fees and your DIN will be deactivated.

Q4. Do foreign directors also need to file DIR-3-KYC?

Yes, all directors with a valid DIN must comply, including foreign nationals.

Q5. Can a company secretary or chartered accountant file on my behalf?

Yes, a practicing CA/CS/CMA can certify and submit your e-form.

Q6. Why did MCA extend the deadline this year?

To ease compliance burden and respond to stakeholder requests.

Conclusion – Key Takeaways for Directors & Companies

The MCA Circular 04/2025 is a timely relief for Indian corporates and directors. With the filing deadline extended till 15th October 2025, companies must act fast to ensure compliance.

The extension avoids unnecessary financial penalties but should not be treated as a reason to delay. Directors should file at the earliest to maintain an active DIN and avoid last-minute technical hassles.

👉 Pro tip: Treat this extension as an opportunity, not a loophole. Early compliance ensures smooth corporate governance and peace of mind.