Introduction

The 56th meeting of the GST Council, held in New Delhi on September 3, 2025, under the chairpersonship of Union Finance Minister Smt. Nirmala Sitharaman, has marked a watershed moment in India’s indirect tax history. Heralded as the dawn of GST 2.0 reforms, the recommendations unveiled are not merely incremental adjustments but a fundamental restructuring of the Goods and Services Tax regime. With a strategic focus on simplification, citizen-centric relief, and trade facilitation, these reforms aim to enhance the ease of doing business and improve the quality of life for every citizen. Effective from September 22, 2025, these changes promise to reshape India’s economic landscape. This article provides a detailed analysis of these landmark decisions, their sector-wise impact, underlying advantages, potential challenges, and answers to frequently asked questions.

Table of Contents

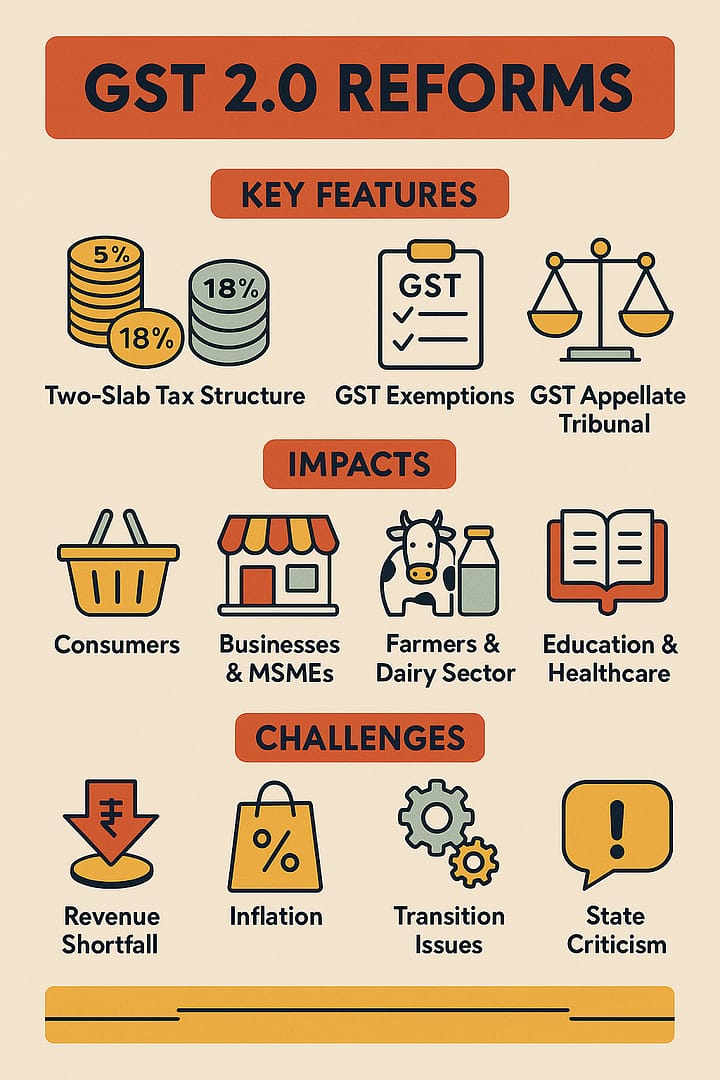

The Cornerstone of GST 2.0 Reforms: A New, Simplified Tax Structure

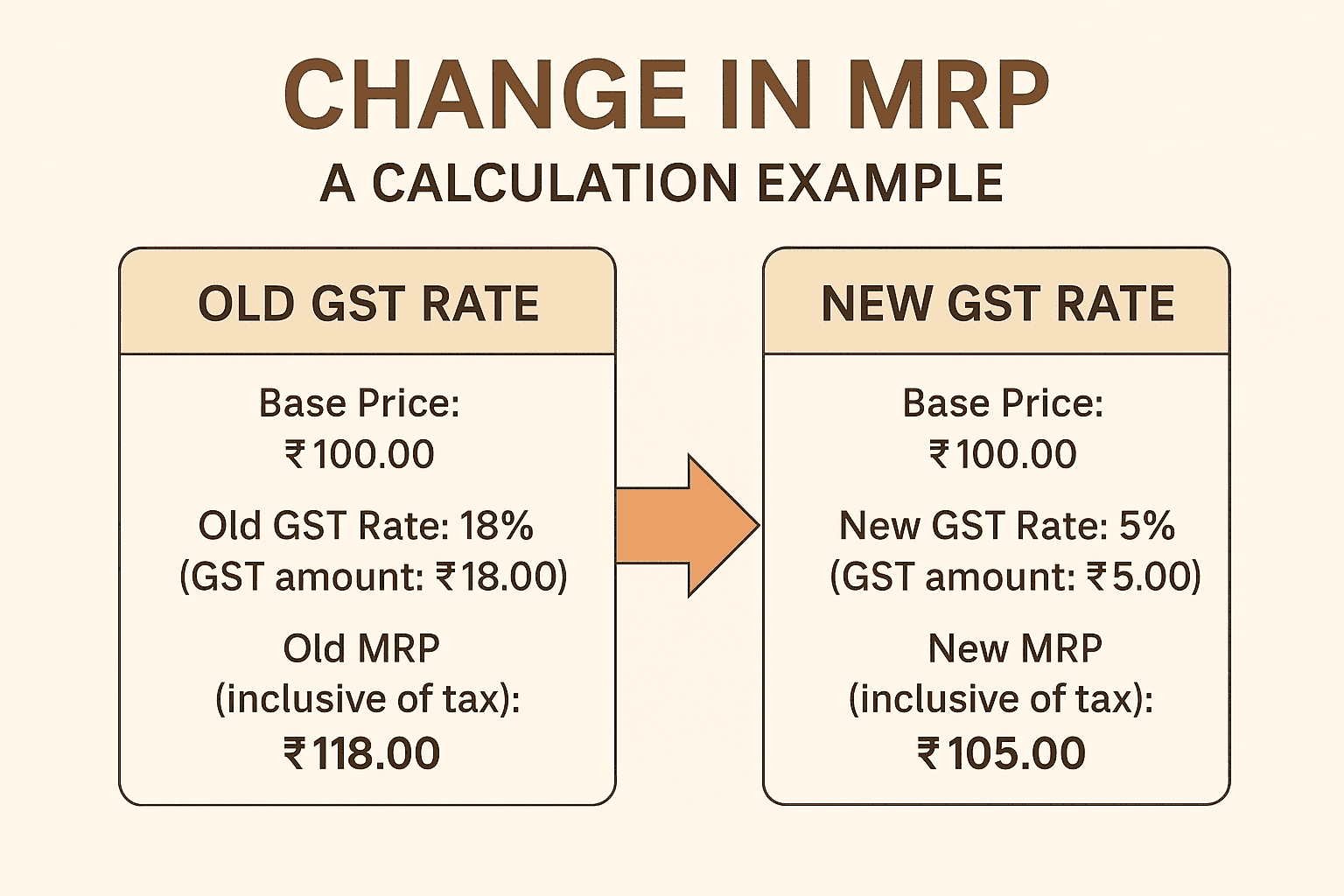

The most significant recommendation from the 56th GST Council meeting is the radical rationalization of the multi-tiered tax structure. This move addresses one of the most persistent criticisms of the initial GST framework—its complexity. The new structure is a bold step towards the “Simple Tax” system envisioned as the next generation of GST.

- From Four Tiers to Two: The existing four-tier structure of 5%, 12%, 18%, and 28% is being consolidated into a more streamlined two-rate system. This simplification is at the heart of the GST 2.0 reforms.

- Merit Rate (5%): This rate will apply to essential goods and services, including a wide range of common consumer items, food products, and agricultural necessities. The objective is to keep the tax burden low on items of mass consumption, thereby controlling inflation and supporting household budgets.

- Standard Rate (18%): This will be the default rate for the majority of goods and services. The convergence of the 12% and 18% slabs into a single 18% rate, along with bringing down many items from the 28% slab, aims to create a uniform and predictable tax environment for businesses.

- A Special De-merit Rate (40%): A new, higher rate of 40% will be introduced for a select few de-merit or sin goods. While the specific list of items is yet to be notified in detail, this category typically includes products like tobacco and pan masala. This special rate ensures that revenue neutrality is broadly maintained while discouraging the consumption of such items.

The transition to this new structure is a monumental step. It is designed to significantly reduce classification disputes, which have been a major source of litigation under GST. For businesses, it means less complexity in compliance, and for consumers, it promises greater transparency in pricing.

Sector-wise Impact Analysis: A Comprehensive Breakdown of the Changes

The GST 2.0 reforms are not just a theoretical restructuring; they bring tangible rate changes across a vast spectrum of goods and services. Below is a detailed examination of the key sectors affected.

1. Relief for the Common Household and FMCG Sector

The Council has prioritized providing direct relief to the common citizen by reducing the tax burden on everyday items. This is expected to lower monthly household expenses and boost consumption in the Fast-Moving Consumer Goods (FMCG) sector.

- Key Rate Reductions: A host of common-use items currently taxed at 18% or 12% will now be taxed at the 5% Merit Rate. This includes:

- Personal care items: Hair oil, toilet soap bars, shampoos, toothbrushes, and toothpaste.

- Household articles: Tableware, kitchenware, and other essential household goods.

- Transportation: Bicycles, a primary mode of transport for many, will also see a rate cut to 5%.

- Societal Impact: This move directly increases the disposable income of middle and lower-income families. The reduced cost of essential goods will help manage household budgets more effectively and could stimulate demand, providing a much-needed impetus to the FMCG industry.

2. A Revolution in the Food, Agriculture, and Dairy Sectors

The food and agriculture sectors have received unprecedented attention in these reforms, with sweeping rate cuts aimed at curbing food inflation and supporting farmers.

- NIL Rate for Staples: Several essential food items have been moved to the NIL rate category, making them more affordable.

- Ultra-High Temperature (UHT) milk.

- Pre-packaged and labelled chena or paneer.

- All Indian Breads, including chapati, roti, paratha, and parotta.

- Reduction to 5% for Processed Foods: A vast array of packaged and processed food items will now attract a GST of 5%, down from 12% or 18%. This is a significant boost for the food processing industry.

- Support for Agriculture: To reduce the input costs for farmers and promote mechanization, the GST rate on agricultural machinery has been slashed from 12% to 5%. This applies to tractors, soil preparation machinery, harvesting and threshing machinery, and composting machines.

- Economic Impact: These measures are expected to have a dual benefit: they will provide relief to consumers by lowering food prices and simultaneously support the agricultural and food processing industries by reducing costs and encouraging value addition.

The table below highlights some of the key HSN-wise changes in the food sector:

| HSN Code/Chapter | Description of Goods | Old GST Rate | New GST Rate (from 22/09/2025) |

|---|---|---|---|

| 1806 | Chocolates and other food preparations containing cocoa | 18% | 5% |

| 1904 | Corn flakes, bulgar wheat, prepared foods from cereal flakes | 18% | 5% |

| 1905 | Pastry, cakes, biscuits and other bakers’ wares | 18% | 5% |

| 2101 | Extracts, essences, and concentrates of coffee and tea | 18% | 5% |

| 2104 | Soups and broths and preparations therefor | 18% | 5% |

| 2105 | Ice cream and other edible ice | 18% | 5% |

| 2106 | Food preparations not elsewhere specified or included (NESI) | 18% | 5% |

3. A Healthier and More Insured India

In a landmark move to enhance social security and make healthcare more accessible, the Council has announced major exemptions and rate cuts in the insurance and healthcare sectors.

- GST Exemption on Insurance:

- All individual life insurance policies (term life, ULIP, endowment) and their reinsurance are now fully exempt from GST.

- All individual health insurance policies (including family floater and senior citizen policies) and their reinsurance are also exempt from GST.

- Rate Reduction on Medicines and Medical Devices:

- 36 life-saving drugs used for treating cancer, rare diseases, and other chronic illnesses will now be under the NIL rate category.

- All other drugs and medicines will be taxed at 5%, down from 12%.

- Medical apparatus, devices, equipment, and supplies (including glucometers, bandages, diagnostic kits) will also see a rate reduction to 5%.

- Impact: This is one of the most impactful decisions of the GST 2.0 reforms. The exemption on insurance premiums will make financial protection significantly more affordable, encouraging higher insurance penetration in the country. Lower taxes on medicines and medical devices will directly reduce out-of-pocket healthcare expenditure for citizens.

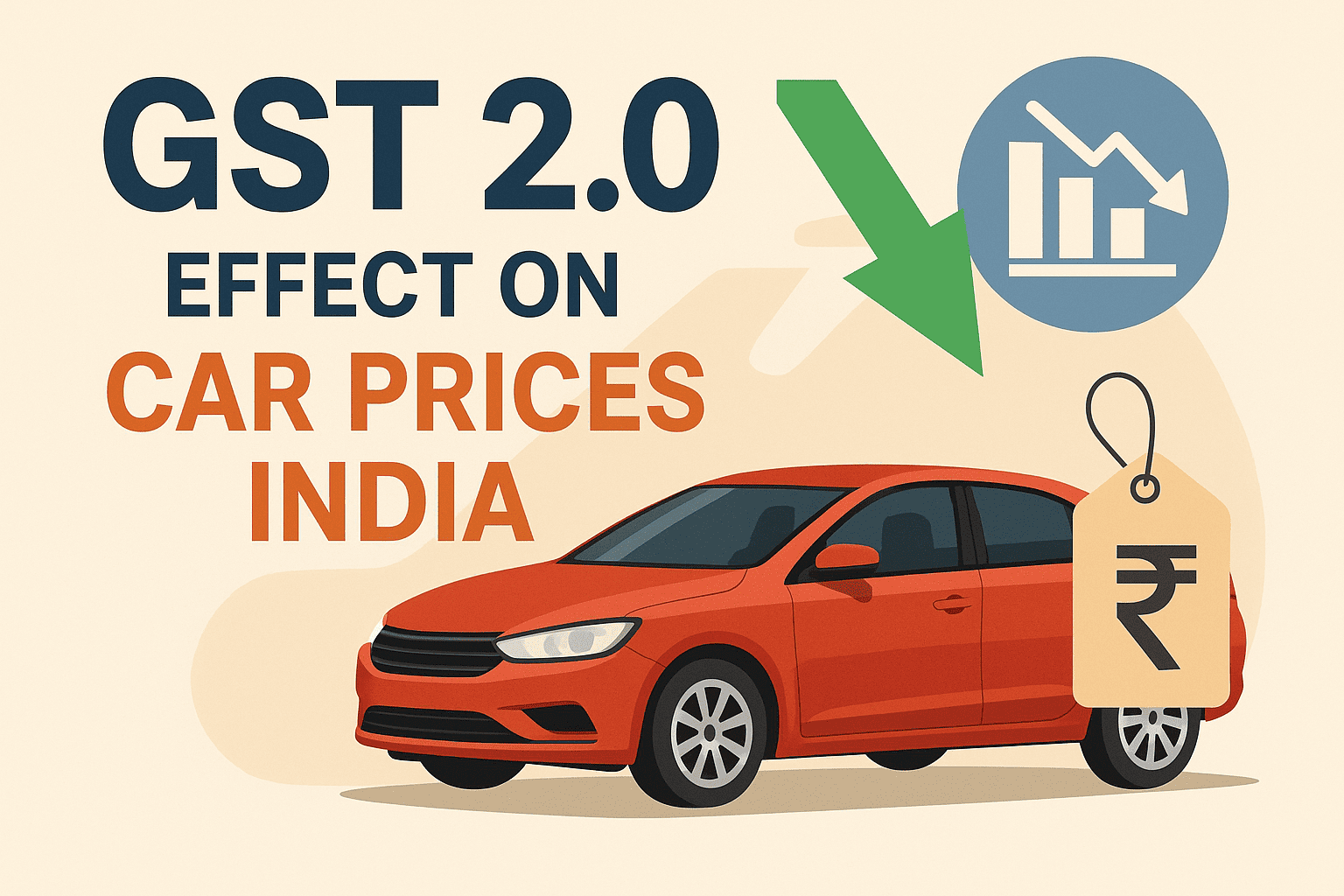

4. Revving Up the Automobile and Manufacturing Sectors

The automobile industry, a key driver of economic growth, has received a substantial boost with rate rationalizations aimed at making vehicles more affordable.

- Key Rate Reductions (from 28% to 18%):

- Small cars.

- Motorcycles with an engine capacity equal to or less than 350cc.

- Buses, trucks, and ambulances.

- Three-wheelers.

- Uniform Rate for Auto Parts: In a major simplification measure, all auto parts, irrespective of their HSN code, will now be taxed at a uniform rate of 18%. This resolves long-standing classification disputes and simplifies compliance for the auto ancillary industry.

- Economic Impact: The reduction in GST rates is expected to translate into lower ex-showroom prices for vehicles, potentially reviving demand in the auto sector. A uniform rate on parts will streamline the supply chain and reduce litigation.

5. Correcting Inverted Duty Structures (IDS)

The Council has addressed the long-pending issue of inverted duty structure in several key sectors. An inverted duty structure, where the tax on inputs is higher than the tax on finished goods, leads to an accumulation of unutilized input tax credit (ITC), creating cash flow problems for businesses.

- Textile Sector: The GST rate on man-made fibre is being reduced from 18% to 5%, and on man-made yarn from 12% to 5%. This correction will make the domestic man-made textile sector more competitive.

- Fertilizer Sector: The rate on key inputs like Sulphuric acid, Nitric acid, and Ammonia is being reduced from 18% to 5%, aligning it with the rate on fertilizers and resolving the IDS issue.

- Impact: These corrections will unlock working capital for businesses, reduce compliance burdens, and promote domestic manufacturing under the “Make in India” initiative.

6. Boost for Services, Hospitality, and Wellness

The services sector, a significant contributor to India’s GDP, has also benefited from the rate rationalization.

- Hospitality: Hotel accommodation services with a value of up to ₹7,500 per unit per day will now be taxed at 5%, down from 12%. This will make mid-range hotel stays more affordable and boost tourism.

- Beauty and Wellness: Services provided by gyms, salons, barbers, and yoga centres will see a steep rate cut from 18% to 5%. This recognizes these services as essential for physical well-being and makes them more accessible to the common man.

Measures for Trade Facilitation and Dispute Resolution

Beyond rate changes, the GST 2.0 reforms include crucial measures to improve the ease of doing business and create a more efficient tax administration system.

- Operationalization of the GSTAT: The Goods and Services Tax Appellate Tribunal (GSTAT) will finally become a reality.

- Timeline: The GSTAT will begin accepting appeals before the end of September 2025 and commence hearings before the end of December 2025.

- Purpose: The GSTAT will serve as the second appellate authority for resolving GST disputes, reducing the burden on High Courts and ensuring faster resolution for taxpayers. The Council has also set a limitation date of June 30, 2026, for filing backlog appeals, providing a clear path for clearing old cases.

- Streamlining GST Refunds:

- Provisional Refunds for IDS: A new system will be implemented for granting 90% provisional refunds arising from Inverted Duty Structure, based on system-driven data analysis and risk evaluation. This will significantly improve cash flow for affected businesses.

- Relief for Small Exporters: The threshold limit for GST refunds on exports made with payment of tax is being removed through an amendment to Section 54(14) of the CGST Act, 2017. This will greatly benefit small exporters who use courier or postal services for low-value consignments.

- Other Procedural Changes:

- RSP-Based Valuation: For Pan Masala, Gutkha, and other tobacco products, GST will now be levied on the Retail Sale Price (RSP) instead of the transaction value. This is a significant anti-evasion measure aimed at plugging revenue leakages in this sector.

The Big Picture: Advantages and Potential Challenges of GST 2.0

Every major reform comes with its own set of opportunities and challenges. The GST 2.0 reforms are no exception.

Advantages:

- Unprecedented Simplification: The move to a two-rate structure is the single biggest advantage. It will drastically reduce classification disputes, simplify compliance for businesses of all sizes, and make the tax system more intuitive for everyone.

- Lower Consumer Prices and Inflation Control: By reducing taxes on a wide range of essential goods and services, the reforms are expected to lower prices for consumers, thereby helping to control inflation and increase purchasing power.

- Boost to Key Economic Sectors: Targeted rate cuts in sectors like automotive, manufacturing, agriculture, and hospitality are designed to stimulate demand, encourage investment, and create employment.

- Improved Ease of Doing Business: Measures like the operationalization of GSTAT and streamlined refund processes will reduce litigation, improve cash flow for businesses, and enhance India’s standing as an attractive investment destination.

- Enhanced Social Security: The complete exemption of GST on life and health insurance is a monumental step towards making financial and health security affordable for all Indians.

Potential Challenges:

- Revenue Implications: Such widespread rate cuts will likely lead to a significant short-term reduction in GST revenue for the government. The long-term expectation is that lower rates will spur economic activity and broaden the tax base, but managing the fiscal deficit in the interim will be a key challenge.

- Implementation Hurdles: Businesses will need to quickly adapt their ERP and accounting systems to the new rate structure. There may be initial confusion and a need for extensive clarification from the CBIC to ensure a smooth transition.

- Phased Implementation Complexity: The decision to continue with existing rates for sin goods until compensation cess obligations are met, while changing rates for all other goods, introduces a temporary complexity. Businesses dealing in both categories will need to manage dual rate structures for a period.

- Impact of the 40% De-merit Rate: While intended to discourage consumption, a high 40% rate could potentially fuel a grey market for these goods if not implemented with robust enforcement mechanisms.

Frequently Asked Questions (FAQs)

Q1. When will the new GST rates recommended by the 56th GST Council become effective?

The new GST rates for both goods and services will be implemented with effect from September 22, 2025.

Q2. What is the new GST rate structure under the GST 2.0 reforms?

The new structure consists of a 5% Merit Rate for essential items, an 18% Standard Rate for most other goods and services, and a special 40% De-merit Rate for select sin goods.

Q3. Will all goods and services transition to the new rates on September 22, 2025?

No. While most goods and all services will transition on this date, certain de-merit goods like Pan Masala, gutkha, and cigarettes will continue at their existing rates until the government’s loan obligations under the compensation cess account are fully discharged.

Q4. What is the most significant change for the insurance sector?

The most significant change is the complete exemption from GST for all individual life insurance and health insurance policies, including their reinsurance. This will make insurance premiums cheaper.

Q5. What is the GSTAT, and why is its operationalization important?

The GSTAT (Goods and Services Tax Appellate Tribunal) is the dedicated appellate body for resolving GST disputes. Its operationalization is crucial as it will provide a specialized and faster forum for dispute resolution, reducing the burden on High Courts and providing quicker justice to taxpayers.

Q6. How will the new reforms help small exporters?

The reforms will help small exporters by removing the threshold limit for claiming refunds on exports made with the payment of IGST. This change, made by amending Section 54(14) of the CGST Act, ensures that even exporters of low-value consignments can easily claim their refunds, improving their working capital.

Conclusion: A New Chapter for GST in India

The 56th GST Council meeting will be remembered as the inflection point that truly transformed the Goods and Services Tax into a “Good and Simple Tax.” The GST 2.0 reforms are comprehensive, bold, and citizen-centric. By simplifying the tax structure, reducing the burden on the common man, correcting systemic issues like inverted duty structures, and strengthening the dispute resolution mechanism, the Council has laid the groundwork for a more efficient, transparent, and growth-oriented indirect tax regime. While the path to implementation may have its challenges, the long-term vision is clear: to create a tax system that fuels India’s economic engine while improving the lives of its citizens. This is not just a reform; it is a revolution.