Table of Contents

Introduction: Why GST 2.0 Matters for the Automobile Sector

The GST 2.0 effect on car prices in India has been one of the most talked-about reforms in recent years. For decades, India’s automobile industry has juggled a mix of taxes—excise duty, VAT, octroi, road tax, and luxury cess. GST 1.0 in 2017 simplified much of this, but cars continued to be among the most heavily taxed goods.

GST 2.0, introduced in September 2025, marks a major policy reset. By reducing tax slabs, removing cess, and cutting rates for small cars and two-wheelers, the reform aims to boost affordability, stimulate demand, and accelerate India’s journey toward becoming a global auto hub.

But how deep is the impact on car prices, consumer sentiment, and industry growth? Let’s take a detailed look.

What Is GST 2.0? A Quick Refresher

Evolution of GST in India

Before GST, buying a car was complicated. Buyers paid excise duty, VAT, and multiple state taxes, with effective tax rates ranging between 35%–50%. GST 1.0 streamlined this into four slabs, but the addition of compensation cess (up to 22%) kept cars expensive.

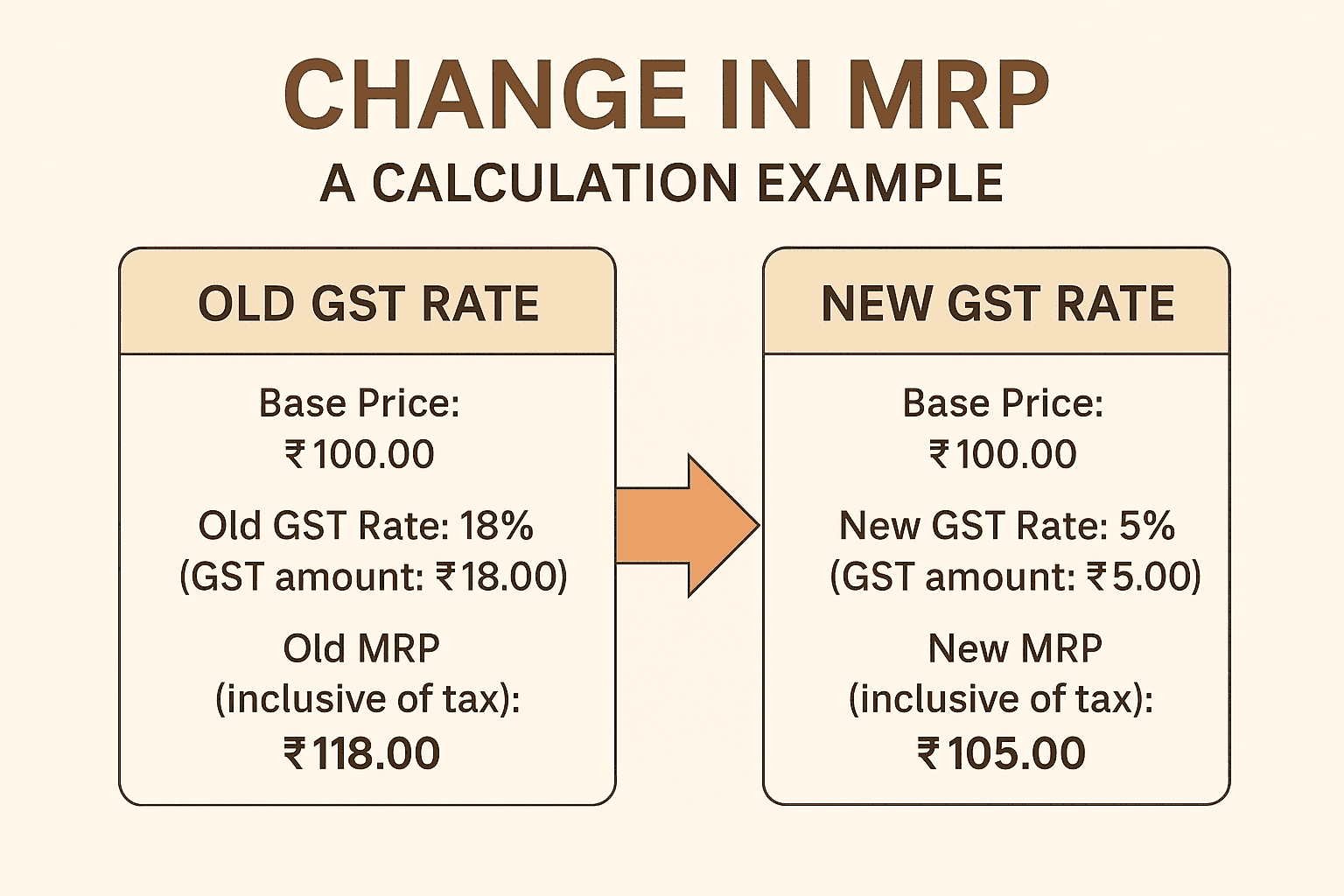

Key Differences Between GST 1.0 and GST 2.0

| Aspect | GST 1.0 (2017–2025) | GST 2.0 (2025 onwards) |

|---|---|---|

| Tax slabs | 5%, 12%, 18%, 28% + cess | 5%, 18%, 40% |

| Small cars | ~29–31% effective | 18% |

| Luxury SUVs | 43–50% | 40% |

| Two-wheelers | 28% | 18% |

| Electric vehicles (EVs) | 5% | 5% |

Takeaway: GST 2.0 makes small vehicles much cheaper, while luxury cars remain premium.

GST 2.0 Rate Structure and Its Impact on Automobiles

New Tax Slabs: 5%, 18%, and 40% Explained

- 5% Slab → Electric vehicles, ensuring India’s EV push stays intact.

- 18% Slab → Small cars (≤ 4m length, ≤ 1200cc petrol/1500cc diesel), compact SUVs, and two-wheelers.

- 40% Slab → Large SUVs, luxury cars, and premium motorcycles.

Reduction in Taxes for Small Cars

The shift from ~31% to 18% GST means an average 12–13% drop in prices for hatchbacks and entry-level sedans.

GST Impact on Luxury Cars and SUVs

Luxury cars are taxed at 40%. While this is lower than the earlier 50% effective rate, automakers warn that affordability at the premium end remains a challenge.

Effect on Electric Vehicles (EVs)

Keeping EVs at 5% GST is consistent with India’s clean mobility agenda. This helps sustain demand even as petrol and diesel cars become cheaper.

GST 2.0 Effect on Car Prices Across Segments

Entry-Level Hatchbacks

Cars like Maruti Alto K10, Hyundai Grand i10 Nios, and Tata Tiago are cheaper by ₹55,000–₹70,000. For first-time buyers in small towns, this is a game changer.

Sedans and Compact SUVs

- Honda City: Prices down by ₹80,000–₹1 lakh.

- Tata Nexon and Kia Sonet: Reduced by ₹1–1.5 lakh.

- Hyundai Verna: Nearly ₹95,000 cheaper.

Compact SUVs, India’s most popular segment, benefit the most in terms of demand revival.

Premium SUVs and High-End Cars

- Toyota Fortuner: Prices increased slightly (~₹1 lakh).

- Mahindra XUV700 (top trims): Higher tax bracket eats into earlier savings.

- BMW/Mercedes-Benz/Audi: Remain expensive due to 40% slab, limiting mass appeal.

Real Price Changes After GST 2.0

Brand-Wise Price Cuts

| Brand | Popular Models | Average Price Reduction |

|---|---|---|

| Maruti Suzuki | Alto, Swift, Baleno, Brezza | ₹45,000 – ₹85,000 |

| Tata Motors | Tiago, Punch, Nexon, Harrier | ₹60,000 – ₹1.2 lakh |

| Hyundai | i20, Venue, Verna | ₹55,000 – ₹95,000 |

| Kia | Sonet, Seltos | Up to ₹1.5 lakh |

| Mahindra | Scorpio-N, XUV700 (lower trims) | ₹1–1.5 lakh |

| Toyota | Innova HyCross (mild cut), Fortuner | Limited relief; some hikes |

Price Reductions in Two-Wheelers

- Honda Activa: ₹12,000 cheaper.

- TVS Jupiter: Savings of ₹10,000–₹15,000.

- Hero Splendor: ₹8,000 reduction, boosting rural demand.

Winners and Losers in the Automobile Market

Middle-Class Car Buyers

The real winners. More Indians can now afford a new car, especially in the ₹5–12 lakh bracket.

Auto Ancillary Industries

Demand surge benefits tyre, battery, glass, and electronics suppliers.

Premium Car Segment Challenges

Luxury carmakers argue that India’s tax policy still discourages premium consumption.

GST 2.0 and Its Influence on Automobile Sales

Festive Season Demand Surge

Dealers report 20–30% higher bookings for hatchbacks and compact SUVs ahead of Diwali.

Dealer and Showroom Feedback

One Delhi-based dealer said:

“We’ve seen double the footfall in September compared to last year. Families are coming back to buy cars they had postponed.”

Stock Market and Investor Sentiment

- M&M surged 8% post-announcement.

- Maruti Suzuki gained 6%.

- Hero MotoCorp jumped 5%.

Analysts expect the auto index to outperform in FY2026.

Impact on Employment and Manufacturing Output

- Car plants in Gujarat, Tamil Nadu, and Haryana are increasing production shifts.

- Suppliers in Pune and Chennai expect 15% higher orders.

- Dealerships are hiring extra staff to manage festive rush.

Future of EVs Under GST 2.0

EVs remain affordable at 5% GST. However, cheaper petrol cars could slow adoption. Still, government subsidies and falling battery costs will support long-term EV growth.

Regional Impact of GST 2.0 on Car Prices

Metro Cities

- Strong demand for compact SUVs in Delhi, Mumbai, and Bengaluru.

- Parking and insurance remain challenges despite lower prices.

Tier-2 & Tier-3 Towns

- Buyers in Lucknow, Jaipur, and Indore show rising interest in hatchbacks.

Rural India

- Two-wheelers see a surge in demand, supported by lower GST and strong monsoon-linked income.

Used-Car Market Impact

- Lower prices for new cars could soften used-car values.

- Platforms like Cars24 and Spinny report higher trade-in volumes post-GST.

Challenges in Implementation and Compliance

- Hybrid cars lack clarity in tax structure.

- Revenue shortfall could pressure government budgets.

- Dealer systems needed urgent updates to avoid invoicing errors.

Government Revenue Impact

The Finance Ministry projects ₹48,000 crore annual loss. However, rising sales could recover some of this through higher GST collection overall.

Expert Opinions and Industry Reactions

- Analyst Pankaj Pandey: “GST cuts have put autos back in the fast lane.”

- Automaker CEO (Maruti): “It’s a shot in the arm for mass car buyers.”

- Dealer networks: “Footfalls doubled within a week of the reform.”

FAQs on GST 2.0 and Car Prices in India

1. What is GST 2.0 and when was it implemented?

Introduced on 22 September 2025, GST 2.0 simplified slabs and lowered rates on small vehicles.

2. Which cars became cheaper?

Small cars, compact SUVs, and two-wheelers saw price cuts of 8–13%.

3. What about luxury vehicles?

They are taxed at 40%, keeping them expensive.

4. Did two-wheelers benefit?

Yes, scooters and commuter bikes are now 10% cheaper.

5. How are EVs treated?

EVs continue at 5% GST, maintaining their tax advantage.

6. Did automakers pass on the benefits?

Yes—brands like Maruti, Hyundai, Tata, Kia, and Mahindra reduced showroom prices.

7. Is the used-car market affected?

Yes, trade-in values dipped slightly as new cars became cheaper.

8. Is this the best time to buy a car?

Yes—price cuts + festive discounts make it ideal.

Conclusion: Is It the Right Time to Buy a Car in India?

The GST 2.0 effect on car prices India has reshaped the auto industry. For middle-class families, it has made car ownership more attainable. For automakers, it has revived demand and encouraged higher production. And for the government, it’s a calculated move balancing affordability with fiscal discipline.

Simply put, GST 2.0 has shifted gears for the Indian automobile sector, driving it toward growth, inclusivity, and modernization. 🚗✨